Quick Take

Nvidia shares fell by 9.5% yesterday, resulting in an approximate $253 billion loss in market value, marking the largest one-day market cap decline for an SPX stock, according to Michael Brown, Senior Research Strategist at Pepperstone FX. To put this in perspective, this drop is nearly equivalent to Ethereum’s entire market cap, which stands at $287 billion as 38th largest asset globally by market cap. Despite reporting strong earnings, Nvidia is now over 20% below its all-time high.

Bitcoin continues to drop but is consolidating just above the $1 trillion market cap. To revisit a $1 trillion valuation, Bitcoin’s price would need to be around $51,000.

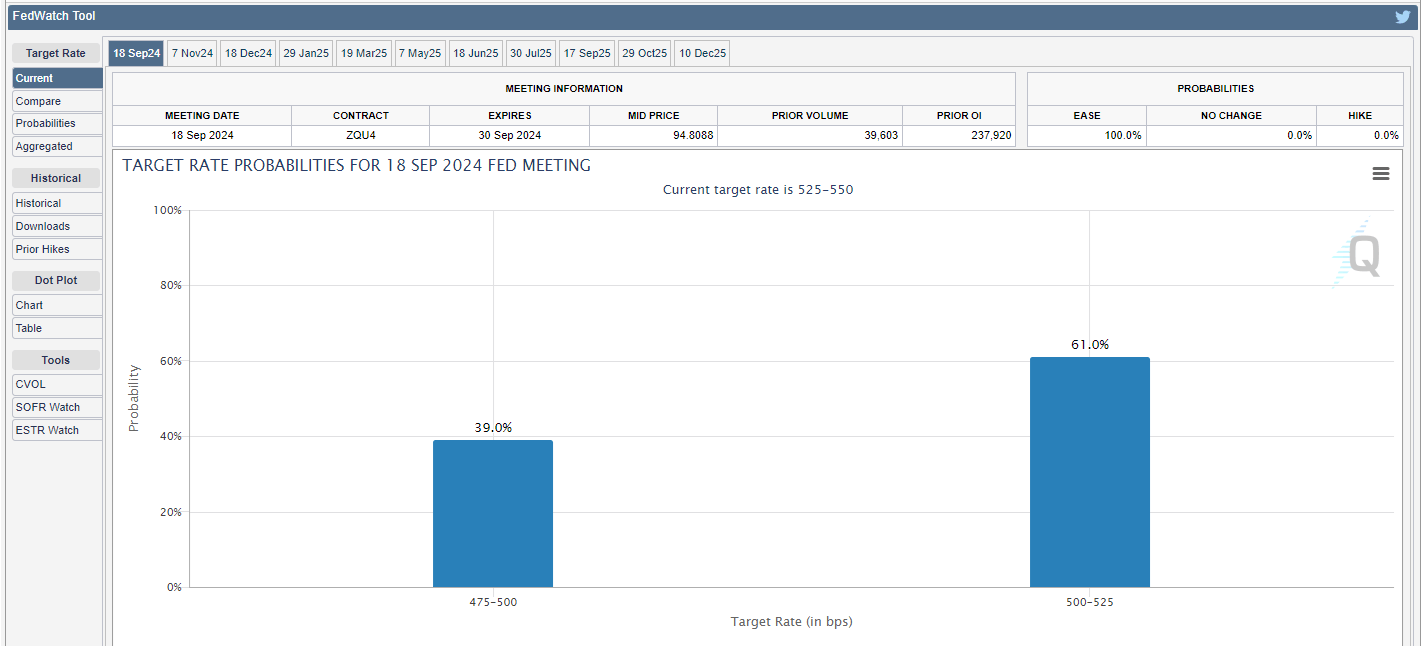

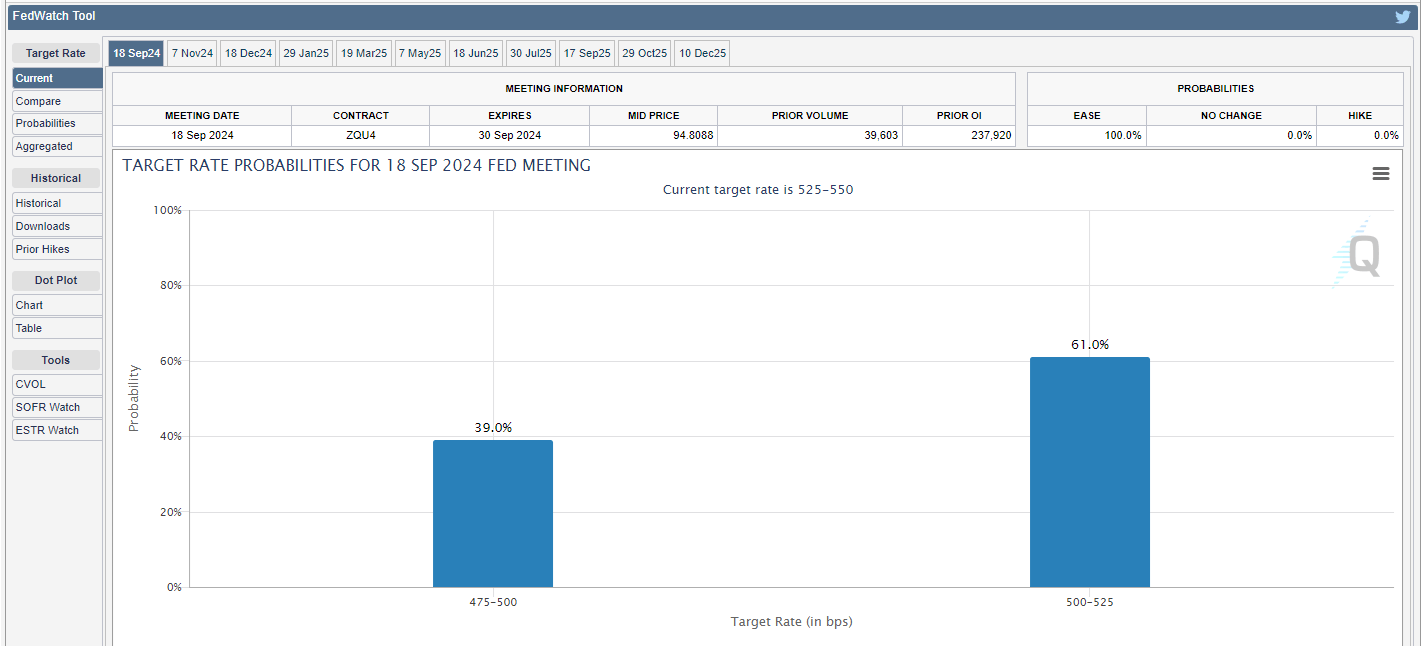

Global markets also experienced sell-offs, with Japan’s Nikkei index down approximately 4% and oil prices falling by 5%. The turbulence is contributing to market uncertainty, especially as the Federal Reserve’s next meeting is just two weeks away, on Sept. 18. Market sentiment is currently split, with a 60/40 likelihood in favor of a 25 basis points rate cut, according to the CME Fed watch tool. Investors are closely watching the Fed’s next move, as it could significantly influence both stock and crypto markets moving forward.