Options are often a leading market indicator, reflecting traders’ expectations for price direction and volatility. This dynamic is especially true for Bitcoin, as the sheer size of the derivatives market has historically outpaced spot trading.

Unlike futures, which are pretty straightforward trading instruments, options trading incorporates strategies that hedge risks or speculate on price and volatility. The complexity of this trading instrument means that any changes in the market — be it open interest, volume, or the ratio of options to futures OI — can significantly impact Bitcoin’s price.

With options becoming a dominant force in the derivatives market, it’s essential to understand how it affects periods of increased price volatility.

The options/futures open interest ratio tells us how much influence options traders have relative to futures and perpetual contracts. In December, this ratio remained in a relatively moderate range, signaling that options hedging behavior was influencing Bitcoin’s price.

As Bitcoin reached an all-time high of over $103,000, options traders likely increased hedging activity to manage delta risk, amplifying price swings. The rise in this ratio shows that options were not just a secondary market but played a meaningful role in price discovery.

However, as the price began to decline, the ratio’s moderation suggested that the influence of perpetuals and futures reasserted itself — but the lingering effects of earlier hedging likely exacerbated the price drop.

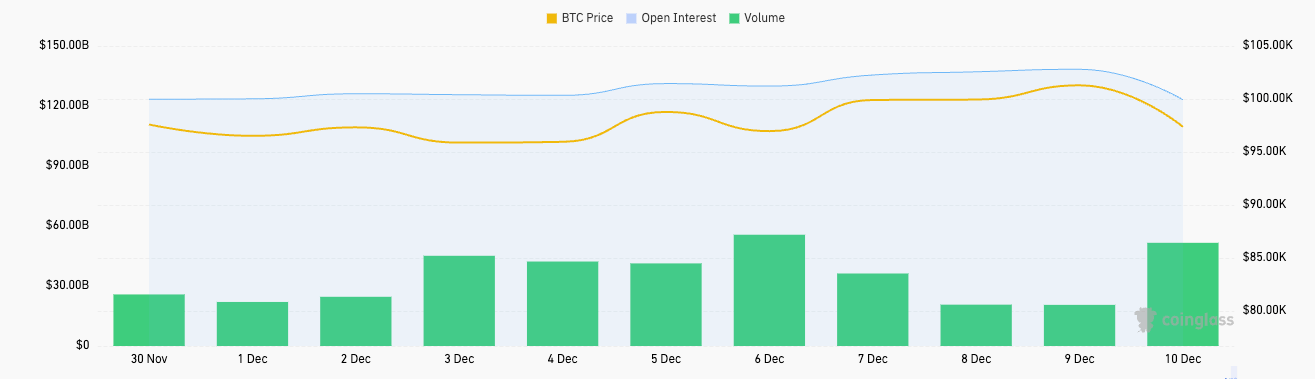

Open interest and trading volume data from CoinGlass further confirm this. Open interest grew steadily in December after a short-lived contraction following its ATH in late November. This steady growth indicates market activity has been ramping up as Bitcoin neared its ATH.

This growth likely included a mix of directional traders speculating on continued price increases and volatility traders positioning for higher implied volatility. The spikes in volume we’ve seen in the past week follow the rise in the ratio, indicating significant trading activity for options. However, as Bitcoin dropped from its ATH of $101,200 on Dec. 9, OI and volume declined, marking a sharp drop in participation.

The unwinding of these positions likely pushed the price down as options trader who hedged delta exposure earlier began closing out their traders, reducing demand for BTC and increasing selling pressure.

The reduced trading volume further compounded the impact. Lower volume means reduced liquidity, making the price more sensitive to big trades. This aligns with the options/futures ratio, which hovered at levels where hedging activity becomes very impactful, especially in a less liquid environment. As options traders adjusted their positions to reflect the declining price, their hedging activity likely involved selling futures or spot Bitcoin, further pressuring the price downward.

All of this data points to the fact that options markets have an outsized role during periods of volatility. The open interest ratio reflects the growing influence of options and shows they’re now central to price discovery. December has demonstrated how this influence can amplify price increases and drops, particularly during decreased liquidity.

The post Options wield outsized influence on Bitcoin’s volatility appeared first on CryptoSlate.