Bitcoin and cryptocurrency trading have gained immense popularity in recent years. But what about crypto margin trading? Is it legal in the US? Margin trading allows traders to borrow funds to increase their trading power, potentially leading to higher profits. However, it also involves higher risks. The legality of margin trading, especially altcoin and Bitcoin margin trading in the US, is a complex issue, so, if you’re considering engaging in this type of activity, it’s crucial to understand the legal landscape and potential risks.

In this article, we’ll explore the legality of margin trading and crypto leverage trading in the USA, including the regulations and restrictions in place, and provide some tips to help you navigate this complex terrain.

Crypto Leverage Trading in the US: Key Takeaways

Margin trading allows you to trade more funds than you own by borrowing a traditional or a crypto asset from your broker.

Crypto leverage trading is legal in the US, but regulation varies from state to state.

The transaction fees associated with crypto margin trading typically involve platform fees, network and transaction costs, and possible liquidation fees.

The best crypto leverage trading platforms in the US are Kraken, Coinbase Pro, and Poloniex.

Some of the risks involved in margin trading include margin calls and liquidation, both of which can cause monumental losses.

What Is Margin Trading?

Margin trading is an advanced trading strategy that allows cryptocurrency traders to open positions with more funds than they actually have. It works by borrowing funds from a broker or an exchange. Essentially, a trader deposits a certain amount of funds as collateral, and the platform lends the trader additional funds to increase their buying power, allowing them to take larger positions than they would be able to otherwise.

One of the main benefits of margin trading is the ability to increase profit potential. With leverage, traders can amplify their gains by taking larger positions in the market. This is particularly useful in the highly volatile world of cryptocurrencies, where prices can fluctuate rapidly, and traders can earn higher profits through well-timed trades.

How Does Crypto Margin Trading Work?

Let’s break it down with Bitcoin as an example. You have $300 and believe Bitcoin’s price will rise. Without borrowing, you can buy $300 worth of Bitcoin, essentially betting on your prediction with a 1x leverage—like playing a game with your own money.

Now, if you’re feeling more adventurous and want to increase your potential winnings, you can opt for 2x leverage. This means you’re borrowing another $300 on top of your own, which gives you $600 to bet on Bitcoin. This borrowed amount, along with your initial $300, acts as a safety net or “margin” for the deal.

However, there’s a catch. If Bitcoin’s value drops, your $300 margin could be in jeopardy. With 2x leverage, Bitcoin would need to lose a significant value before the platform steps in, but if it does, they might ask you for more money to keep the trade open, known as a “margin call.” If things move too quickly or you can’t top up your account, the platform might close your position to recover the loan and any interest, leaving you with a loss.

Using low leverage is like walking a tightrope with a safety net. It’s riskier than keeping your feet on the ground but safer than flying without a parachute. And for the thrill-seekers, some platforms offer up to 200x leverage, where even a tiny drop in Bitcoin’s price could mean game over for your trade.

Risks Associated with Margin Trading

Margin trading can be an effective tool for experienced traders to amplify their profits in the highly volatile cryptocurrency market. However, the use of leverage also exposes traders to potential risks and losses. In this section, we will outline various risks associated with margin trading in the US and provide insights on how traders can mitigate these risks to improve their chances of success.

The Horrendous Margin Calls

Margin trading can be an effective strategy for experienced traders looking to amplify their gains in the crypto market. However, it comes with a significant level of risk and responsibility. One of the most feared aspects of margin trading is the margin call.

A margin call occurs when the value of a trader’s assets falls below the minimum margin requirement set by the exchange. This minimum requirement is the lowest amount of equity that a trader needs to maintain in their account relative to their leveraged position. If the value of the underlying asset decreases significantly, the equity in the trader’s account may no longer meet the minimum margin requirements.

When a margin call is triggered, the trader will receive a notification from the exchange to add more funds to their account to maintain the minimum margin requirement. If the trader fails to top up their account, the exchange may liquidate their position, selling off their assets to cover the margin requirements.

This can be a devastating blow, resulting in significant losses that can wipe out a trader’s entire account. To avoid being caught in a margin call, it’s essential for traders to have a solid understanding of the margin requirements and to implement risk management strategies.

One of the risk management strategies is to always set stop-loss orders to prevent significant losses. Additionally, traders can consider using lower levels of leverage and trading only with funds that they can afford to lose in case of a margin call.

It’s worth noting that margin calls are not exclusive to crypto trading. They occur in traditional markets as well, and the consequences can be just as severe. Therefore, traders must always practice caution and employ strategies that minimize risk while maximizing gains.

Liquidation of Collateral

When engaging in regular and crypto margin trading, it’s important to understand the concept of collateral and how it factors into the liquidation process. When a trader opens a leveraged position, they must deposit collateral. This collateral serves as a guarantee that the trader can cover their potential losses.

If the value of the trader’s assets begins to decline and falls below the minimum margin requirement set by the exchange, they may receive a margin call. This means that they’re required to add more collateral. Otherwise, they risk having their position liquidated.

Liquidation occurs when a trader’s collateral can no longer cover their losses, and the exchange or brokerage closes their position and sells their collateral to repay the borrowed funds. In simpler terms, this means that the trader’s assets are sold off to help offset their losses.

The process of liquidation is commonly influenced by exchange policies and the trader’s actions. The exchange will have specific policies and procedures to determine when a trader’s position should be liquidated. These policies will usually depend on factors such as minimum margin requirements, the volatility of the assets in question, and the amount of leverage used.

Speaking of a trader’s actions, they can also contribute to the likelihood of their position being liquidated. For example, if a trader uses significant leverage or if they fail to maintain adequate collateral in their account, they’re at a higher risk of having their position liquidated.

Is Cryptocurrency Margin Trading Legal in the USA?

Margin trading has become increasingly popular within the cryptocurrency market. However, being a high-risk financial product, this type of trading is subject to strict regulations, especially in the US.

US citizens who wish to participate in margin trading of cryptocurrencies must do so on regulated exchanges that comply with the guidelines set forth by supervisory authorities such as the Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA). These include licensed futures commission merchants (FCMs) and registered introducing brokers (IBs) who offer leverage trading.

The CFTC has classified cryptocurrencies, including Bitcoin and Ethereum, as commodities, hence ensuring that they fall under the jurisdiction of their regulatory mandate. This regulatory body has enacted several regulations that exchanges must follow to operate as legitimate margin trading service providers for US citizens.

Furthermore, regulated exchanges must provide clear guidance on specific margin requirements and maximum leverage limits for each trading pair. This information helps crypto traders make informed decisions about the risks of margin trading and their potential losses when participating in the cryptocurrency market.

What about other countries?

In the UK, the oversight of financial derivatives, including futures, falls under the jurisdiction of the Financial Conduct Authority (FCA). In a move to protect retail consumers from the high risks associated with crypto derivatives, the FCA implemented a ban on their sale in 2020. However, margin trading for other types of trading instruments remains permissible, albeit with restrictions on the amount of leverage available to traders.

Canada presents a somewhat challenging regulatory landscape for crypto margin trading. In 2022, the Canadian Securities Administrators (CSA) introduced a ban on margin trading on crypto platforms, signaling a cautious approach towards the volatility and risk inherent in the crypto market.

Australia’s approach to margin trading strikes a balance, allowing it only within regulated limits. The Australian Securities and Investments Commission (ASIC) is responsible for setting these limits, including maximum leverage ratios. A notable enforcement action occurred in 2023 when ASIC brought civil charges against Kraken’s Australian exchange provider, Bit Trade Pty Ltd, highlighting the regulatory scrutiny in the region.

The tightening of regulations worldwide has led to significant shifts in the operations of crypto exchanges. For instance, Binance withdrew from the Canadian market in 2023, reflecting the challenges posed by new regulatory measures. Additionally, many exchanges have resorted to geofencing techniques. This technology restricts access to the exchange’s services based on the user’s geographical location, effectively preventing individuals from regions with stringent regulations from participating in margin trading on their platforms.

What Are the Fees Related to Crypto Margin Trading in the USA?

One of the main fees associated with margin trading is platform fees. These fees cover the cost of using the platform and the margin trading service provided by the exchange. Some exchanges charge a percentage of the trade amount as a fee, while others charge a fixed rate. Traders should research the platform fees and take them into account when making margin trades.

In addition to platform fees, traders may also incur liquidation fees. Liquidation fees are charged if a margin position is closed due to a lack of funds or margin maintenance. These fees can vary depending on the exchange and the size of the position.

Traders should also consider the corresponding network and transaction costs associated with the underlying blockchain. These costs are not directly related to margin trading fees, but they can impact the overall cost of margin trading. Blockchain network fees are charged for transacting on the blockchain and are often dynamic and depend on network congestion.

How To Start Leverage Trading Crypto in the USA

People often ask if they can leverage trade crypto in the US. The answer is yes, but it’s not as easy as in other countries due to strict regulations. Only a few exchanges with a FinCEN Money Service Business license, such as BitMart, can offer margin derivatives products. Obtaining this license subjects service providers to intense regulatory scrutiny, which many platform owners find not worth the hassle. Some opt to open off-shore exchanges with fewer hurdles to pass. To trade leveraged tokens and coins in the United States, you need to know which exchange offers the right product under the right regulation. Here are some of the best crypto leverage trading platforms available to US citizens.

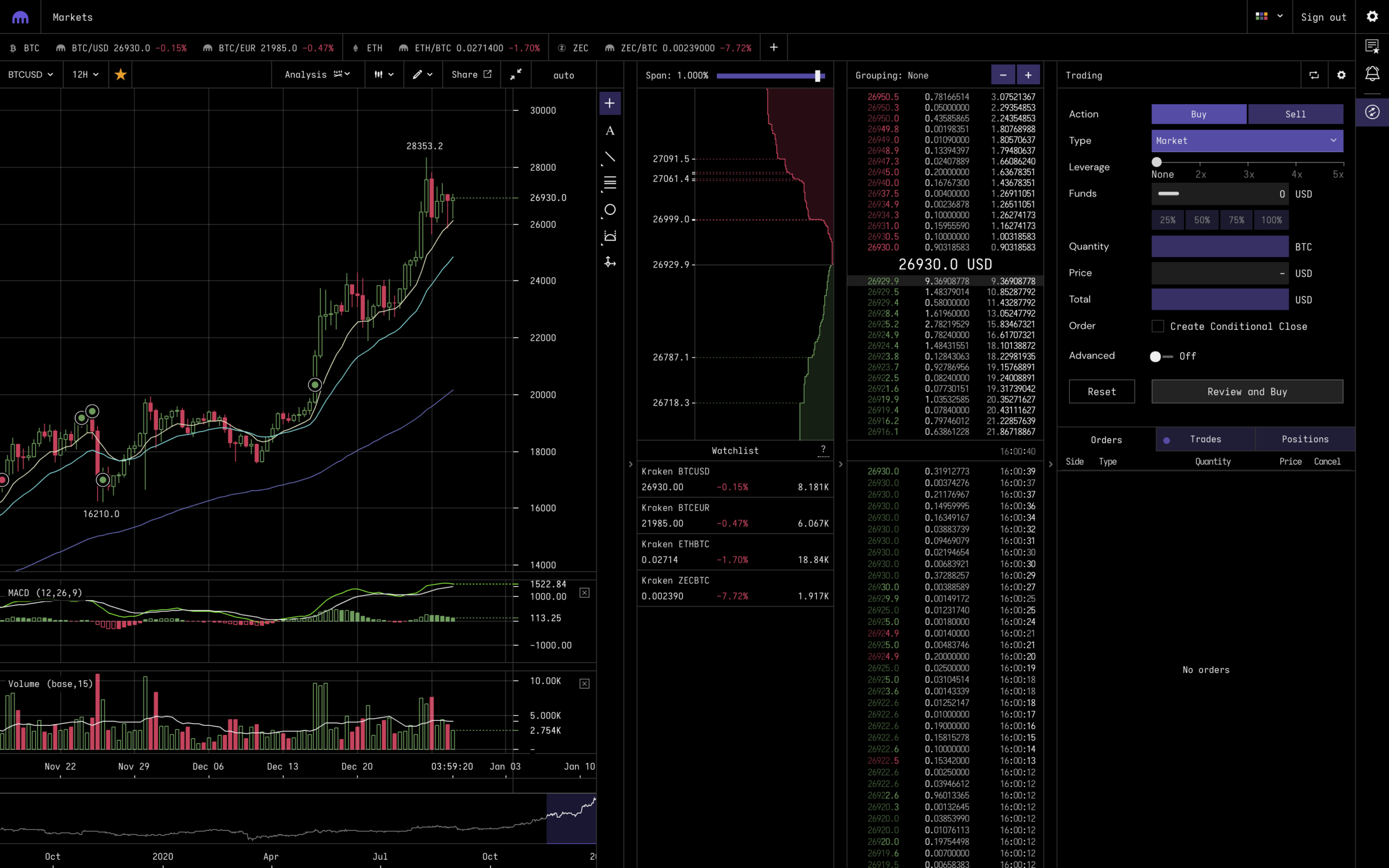

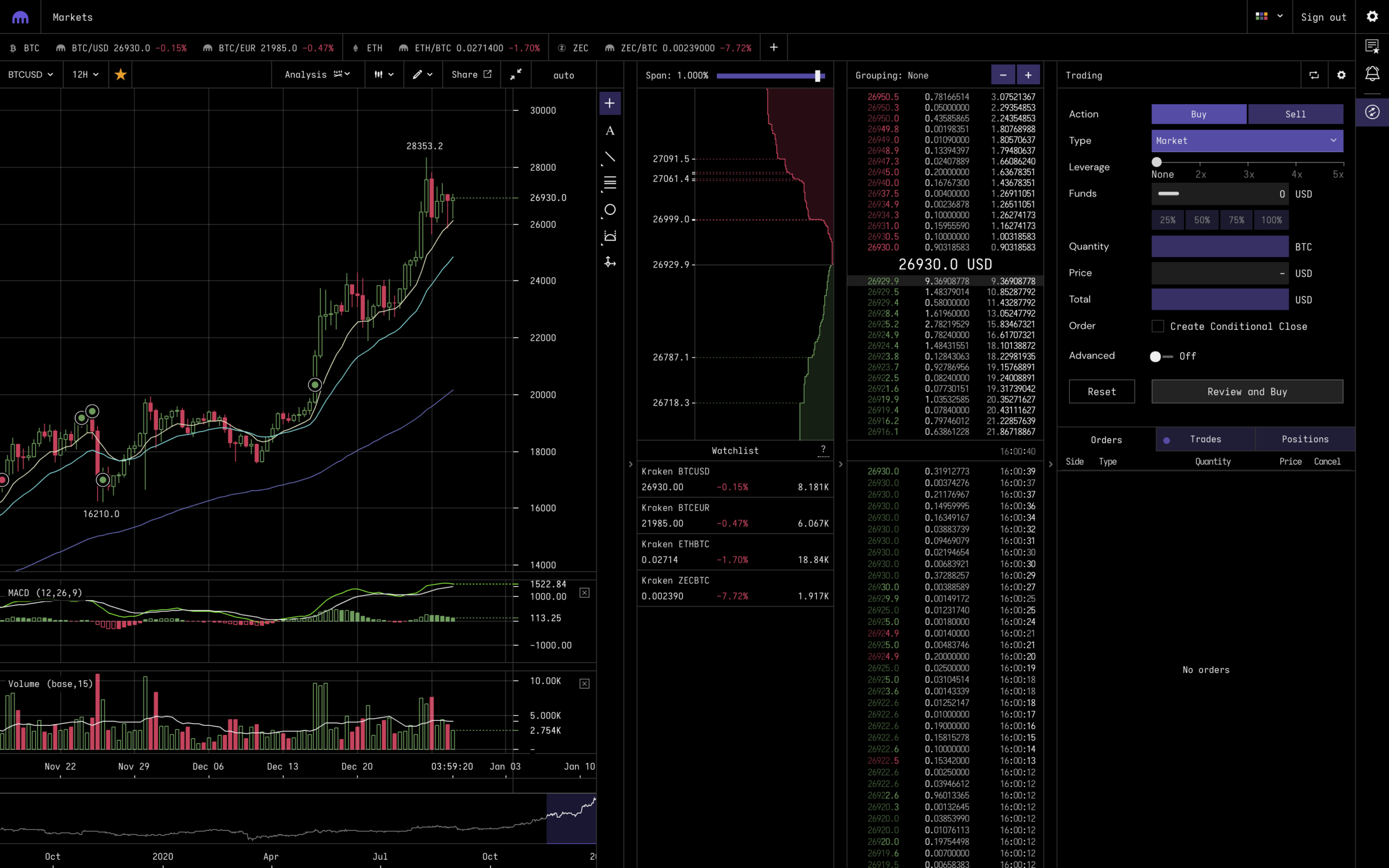

Kraken.com – Overall Best Crypto Leverage Trading Platform

If you are a US citizen interested in margin trading cryptocurrencies, Kraken.com is the platform for you. Kraken is a leading crypto exchange and margin broker that provides users with a high level of security, a user-friendly interface, a variety of trading pairs, and low trading fees.

Security is a top priority for Kraken, which is why they employ a number of measures to keep user funds and personal information safe. Kraken uses two-factor authentication, SSL encryption, and cold storage to protect user accounts and ensure the integrity of data.

Kraken’s trading interface is easy to use and navigate, making it ideal for both experienced traders and beginners. The platform offers a wide range of trading pairs with fiat currencies and cryptocurrencies, allowing traders to diversify their portfolios and take advantage of market opportunities.

In terms of fees, Kraken charges some of the lowest trading fees in the industry. Besides, Kraken offers many margin trading options, including small leverage, which provides a level of protection against potential losses, as well as larger trade positions with up to 5x leverage. This allows traders to choose the leverage most suitable for their trading strategy and risk profile.

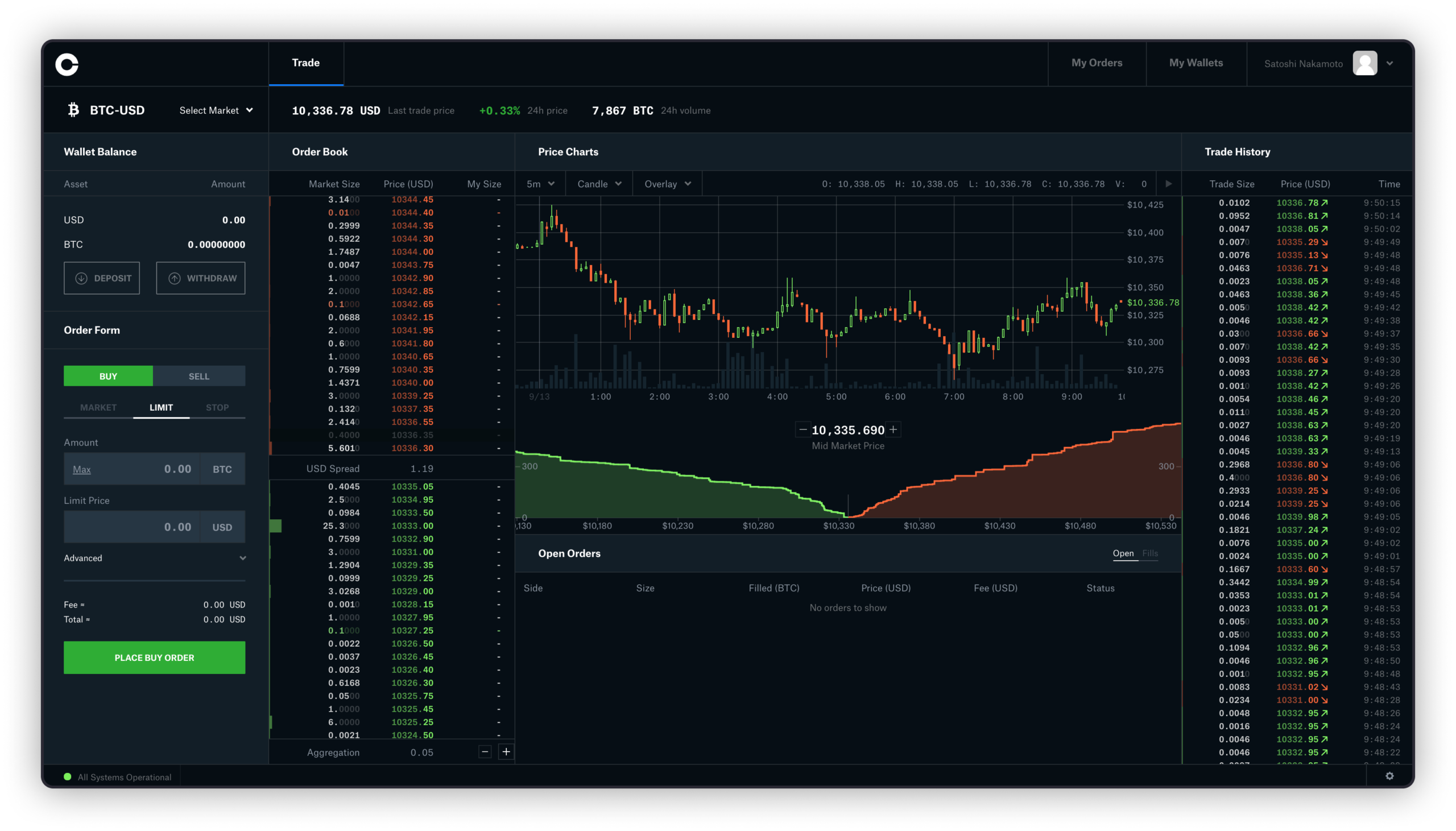

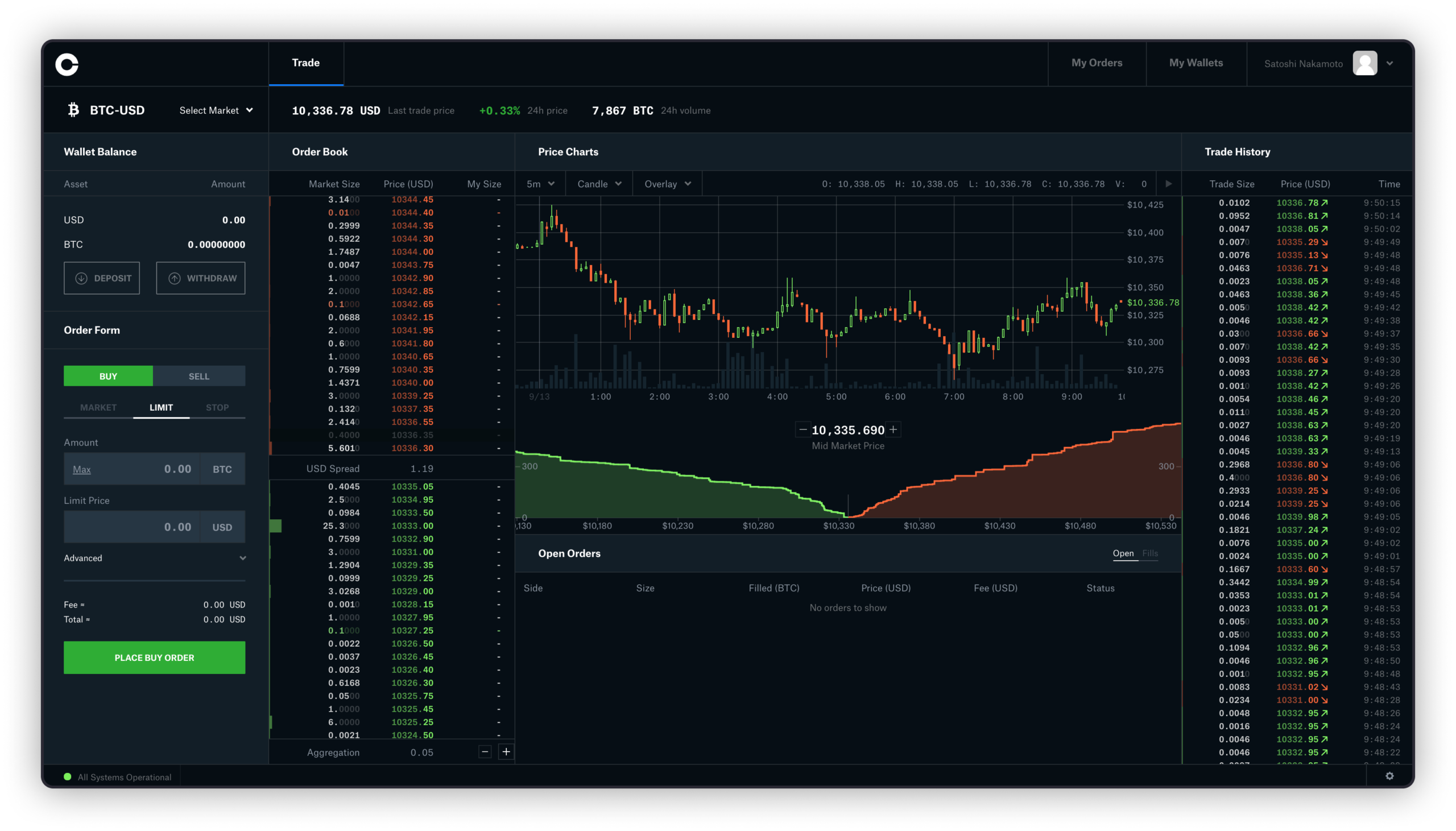

Coinbase Pro – The Coinbase Margin Broker Platform

Coinbase Pro is a margin trading platform by Coinbase, one of the most popular crypto exchanges in the United States. As a margin broker, Coinbase enables users to amplify their trading power by borrowing funds from the platform.

One of the key features of the Coinbase margin trading platform is the range of trading pairs available to users. This includes cryptocurrency pairs such as BTC/USD and ETH/BTC, as well as fiat currency pairs like USD/EUR and USD/GBP.

To begin margin trading on the Coinbase Pro platform, users must meet certain margin requirements depending on the trading pair they select and the level of leverage the trader wants to use.

On Coinbase, traders can choose from a plethora of leverage options, with the maximum leverage being 3x. This may be lower in comparison to other margin trading platforms, yet these conditions can still be enough for traders to increase their returns.

When it comes to trading fees, Coinbase Pro charges a maker-taker fee of up to 0.5% for margin trades. There is also a minimum deposit amount of $10, which is relatively low compared to other margin trading platforms.

One unique aspect of the Coinbase margin trading platform is the availability of educational resources and tools for margin traders. These resources include articles, videos, and webinars that cover multiple topics, including trading strategies and risk management.

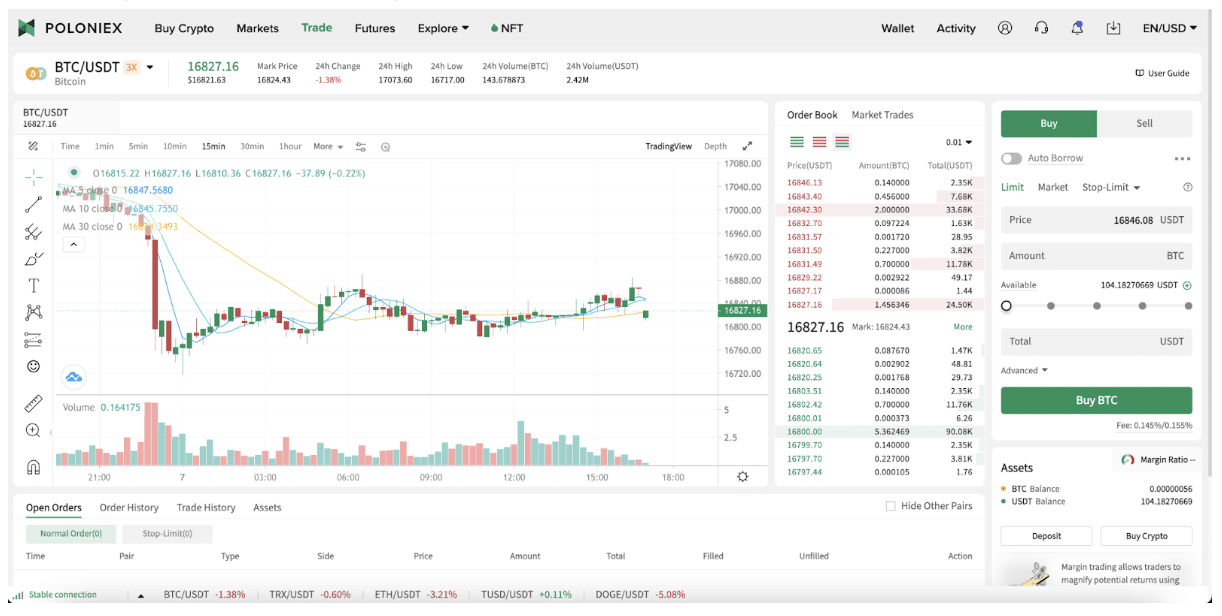

Poloniex – One-Stop Shop for Crypto Margin Trading

Poloniex Margin Trading is a popular feature of the Poloniex cryptocurrency exchange that allows users to trade with borrowed funds, giving them a chance to potentially increase their returns on investments. The platform is packed with features and benefits but also has some drawbacks that users should be aware of.

One of the most enticing features of Poloniex Margin Trading is the range of cryptocurrency pairs available for trading (e.g., Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and other popular cryptocurrencies).

Margin requirements on Poloniex vary depending on the trading pair and leverage. The platform has leverage options from 2.5x to 5x. Apart from inherent risks, users should also be aware of the potential drawbacks of margin trading on Poloniex. The platform does not offer fiat currency pairs, meaning that users must already possess crypto to initiate a margin trade.

In terms of trading fees, Poloniex charges a maker-taker fee of up to 0.125% for margin trades.

As we said previously, margin trading is regulated by the relevant supervisory authority in the US, ensuring that traders have access to a secure and transparent trading environment. However, traders need to do their own research and choose reputable platforms that offer fair margin requirements, competitive trading fees, and an array of complex order types and advanced trading interfaces.

Another great crypto trading platform is eToro. They support crypto, derivatives trading, margin spot trading, and more. However, eToro does not offer leverage trading options in the US.

Best Cryptocurrency/Bitcoin Margin Trading Tips

Margin trading amplifies both profits and risks. In this section, we will provide some of the best cryptocurrency and Bitcoin margin trading tips to help traders navigate the complexities of leveraged trading and maximize their returns while minimizing risks.

1. Always Start with Small Amounts

When it comes to trading cryptocurrencies on margin in the US, it’s always important to remember that this is a high-risk, high-reward endeavor. One key way to mitigate potential losses and minimize risk is to always start with small amounts.

Starting with small amounts can help inexperienced traders get a feel of the market and understand the mechanics of leverage trading without risking too much capital upfront.

2. Don’t Go All-In at Once

One common mistake that beginners make when entering the world of margin trading is putting all their investments into one position. While this can seem like a logical decision, as it increases the potential rewards of a successful trade, it also introduces significant risks that can lead to substantial losses if the trade goes south.

The consequences of such a decision can be severe, because a failed position can result in the liquidation of collateral, further compounding financial losses. In extreme cases, traders can lose everything they have in one catastrophic trade, unable to recover the funds they initially invested.

Starting with small amounts and developing a disciplined approach to cryptocurrency margin trading can help avoid this scenario. Traders should consider diversifying their holdings across multiple currencies and assets, building up positions over time. Not only does this reduce overall risk but also increases the chances of success in the long run.

Several successful traders have espoused the importance of patience and discipline in margin trading. For example, legendary investor Warren Buffet famously said,

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1.”

In the crypto sphere, trader Nick Leeson, who made millions in the early days of Bitcoin, advises traders to “control their emotions and trade with discipline” to succeed in the high-risk world of crypto margin trading.

3. Don’t Disregard Volatility

Cryptocurrencies are inherently volatile assets, with their prices fluctuating dramatically over short periods of time. When combined with leverage, this volatility can be amplified, resulting in greater potential rewards and higher risks.

In margin trading, traders borrow funds from the exchange to magnify their returns on a particular trade. However, this also means that losses can be equally amplified, and rapid decreases in the market can lead to margin calls and the liquidation of positions.

To manage this risk, it is important for traders to establish clear risk management strategies. One approach is to set stop-loss orders, which automatically close a position if the price of an asset falls below a certain threshold.

Another strategy is to diversify investments across multiple currencies and trading pairs, reducing overall exposure to one asset. This is particularly important in the highly dynamic crypto market, where new assets and trends can emerge rapidly and impact prices unpredictably.

4. Learn the ABCs of Margin Trading

In crypto margin trading, it’s essential to grasp a few key concepts to manage your trades effectively. Here’s a simplified breakdown:

Initial Margin: This is the initial deposit you put down to open a trading position. It acts as collateral in your margin trading account.

Margin Level: This represents the minimum amount of money you must keep in your margin account to support your open positions.

Maintenance Margin: This is additional collateral required to keep your positions open. For instance, if you’re in a short position and the market price rises, your margin level will be affected, potentially leading to a margin call.

Margin Call: This is an alert from your exchange or trading platform indicating that your margin level has dropped too low. To avoid liquidation, you’ll need to add more funds to your account.

Liquidation: If your account cannot sustain the minimum margin level, the platform may automatically sell off your collateral to cover the losses, a process known as forced liquidation.

Crypto Margin Trading: FAQ

Is margin trading crypto risky?

Yes, margin trading in crypto is risky. It’s like betting more money than you have on a race. If your prediction is wrong, you could lose your money quickly.

What is 10x leverage in crypto?

10x leverage in crypto means you’re betting ten times the amount of money you actually have. If you have $100 and use 10x leverage, you’re trading with $1,000, aiming for bigger wins but also facing the risk of larger losses.

Does Binance US support margin trading?

No, as of March 2024, Binance does not offer margin trading services.

Can US traders use leverage?

Yes, US traders have access to leverage when trading certain financial instruments, such as futures contracts, options, and margin accounts offered by regulated brokers. However, the availability and specific regulations surrounding leverage may vary depending on the financial product and the broker/platform being used.

Can US citizens trade crypto on margin?

Yes, US citizens can trade cryptocurrencies on margin. Some cryptocurrency exchanges and trading platforms, both within and outside the United States, offer margin trading services to eligible users, including US citizens. It is essential to comply with the regulations imposed by specific exchanges and to meet their requirements, such as minimum equity thresholds or verification processes.

Can US citizens margin trade on Kraken?

Yes, US citizens can engage in margin trading on Kraken. Kraken is a well-known and reputable cryptocurrency exchange that provides margin trading services to eligible users, including those from the United States.

Can you short crypto in the USA?

Yes, shorting cryptocurrency is possible in the USA. Short selling allows traders to profit from a decline in the price of a cryptocurrency by borrowing and selling it with the intention of buying it back at a lower price in the future to cover the borrowed amount. However, it is essential to conduct short selling through platforms or brokers that comply with regulations and requirements set by relevant financial authorities in the United States.

Can you trade crypto on 100x leverage?

You can trade crypto futures on 100x leverage on the BitMart Futures trading platform. However, please keep in mind that this is incredibly risky, and you shouldn’t enter trades like that unless you are absolutely confident you know what you’re doing. While the potential profits you can earn from trading digital assets on 100 or 50x leverage are high, so are the potential losses.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.