Recently, the public’s attention was captured by the “12 Days of OpenAI” event, during which OpenAI unveiled new advancements in its AI models every day. Users’ demands are clear: we want AI to be faster, smarter, and more capable. This naturally plays into Nvidia’s hands. However, as the race for technological dominance accelerates, an unexpected obstacle has emerged – a lack of energy.

While Nvidia, the giant developing the most powerful AI chips, has seen its shares rise an impressive 178% this year, the true winner has been Vistra Corp. If this name doesn’t ring a bell, you’ve missed one of the most profitable AI investments of the year. This company’s shares have risen by over 280% in 2023. So, what’s behind this staggering growth?

Vistra’s shares have surged by 280% this year, driven by growing investor optimism.

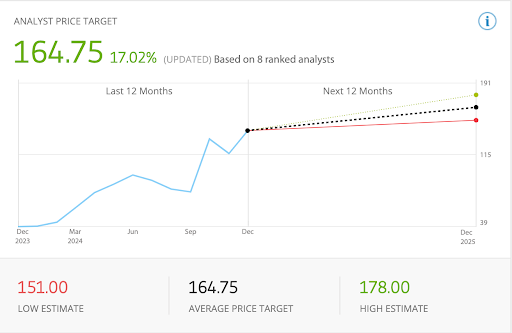

Wall Street has set a target price of $164 per share, indicating a 24% growth potential. All 10 analysts rate it as a “Strong Buy.”

The demand for renewable energy, spurred by the expansion of data centers, particularly in Texas, represents a key growth opportunity for Vistra.

Why is computing power not AI’s biggest obstacle?

Artificial intelligence requires enormous computing power, which drives the demand for the most advanced AI chips. However, more powerful chips consume more energy and generate more heat, requiring complex cooling systems. This significantly increases their energy consumption.

As the AI systems market grows exponentially, so does the need for new data centers. See where I’m going with this? The expansion of this sector is drastically increasing the demand for electricity. But not just any electricity – hyperscalers prefer green energy sources, both for tax incentives and stakeholder interests, which is why their focus is turning to renewable energy sources.

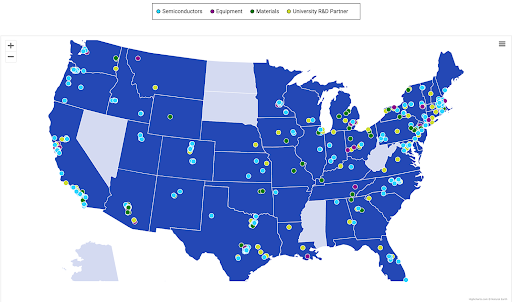

Map of data centers in the USA (datacentermap.com)

But increasing consumption is not the only factor boosting renewable energy demand. Data centers, which consume massive amounts of energy, are highly concentrated in just a few areas in the United States.

The hottest regions are Virginia, Texas, and California. Because of this, huge amounts of demand are being placed on small sections of the power grid, which are already nearing their limits.

In Texas, developers are lured in by good transmission infrastructure and low real estate costs. In its electricity grid, called ERCOT, the share of data center related demand is expected to reach 10% of overall consumption in 2025. While this provides a significant opportunity for electricity providers, it also creates challenges.

To avoid negative impacts on distribution networks and households, data centers are moving closer to power sources, known as co-location. This has led to a significant increase in demand for renewable energy in a handful of key areas.

Which brings us to Vistra.

How does Vistra fit into this?

Vistra is one of the largest renewable energy providers in Texas. Its portfolio includes a wide range of sources – from natural gas and nuclear energy to wind and solar, including battery storage. The demand from data centers in Texas is a strong tailwind for the company.

Vistra’s clients already include hyperscalers such as Microsoft and Amazon. Two other unspecified hyperscalers are already in discussions with Vistra to build new natural gas power plants co-located with data centers to ensure maximum efficiency and speed. Co-location, the practice of building data centers in close proximity to power plants, also reduces transmission loss and alleviates pressure on the grid. But more and more tech firms are seeking reliable energy sources, and it’s not just for data centers.

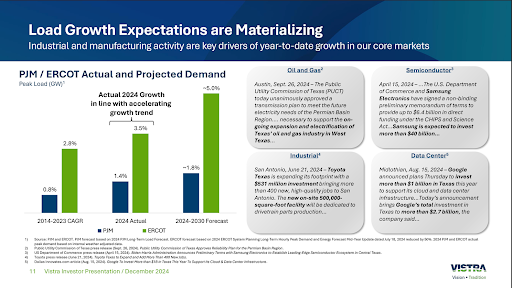

Map of chip factories in the US (semiconductors.org)

The chart above shows the distribution of chip manufacturing facilities in the US. For many of the same factors that apply to data centers, in addition to it’s favorable legislation and advantageous geographical position within the US, Texas is a hot spot for chip manufacturing facilities.

Companies are also leveraging Biden’s CHIPS Act to fund their expansion in this region, such as the recently finalized plant financing for Samsung and Texas Instruments.

Vistra’s large footprint in the region has allowed it to benefit from rising demand, resulting in revenue and earnings growth far above the sector median. But demand that outpaces supply has caused customers to look for alternative ways of powering their facilities.

Nuclear power attracts tech giants

Traditional renewable sources, such as solar and wind power, have a major drawback – their output fluctuates. Solar panels won’t generate energy when the sun isn’t shining, and weather is a risk factor for both. This is a problem for data centers, which require reliable 24/7 power. The solution might be a step back – to nuclear energy.

(vistracorp.com)

While interest in nuclear energy has been on the decline, these market developments are fuelling a resurgence. Small modular reactors, or SMR, have attracted the attention of giants such as Microsoft to supply nuclear energy to data centers. Nuclear plants are a good solution for data centers due to their ability to produce large amounts of clear energy without interruption.

Vistra is in a favorable position here with its Comanche Peak nuclear power plant in Texas, which has the potential to become a key hub for powering energy-intensive technological infrastructure. Comanche Peak, a two-unit facility with a capacity of 2,400 megawatts, has recently received approval from the Nuclear Regulatory Commission to extend its operation through 2053.

What’s next for Vistra in 2025?

Investors will be keen to see how demand for artificial intelligence continues to evolve. Signals from tech giants like Amazon, Google, Microsoft, and Meta are clear – they all aim to take the lead in AI and are ready to invest billions. The expansion of data centers will continue, meaning further growth in energy demand.

(eToro)

Wall Street is placing high bets on the company. 10 out of 10 analysts rate the stock as a “strong buy”, with even the most pessimistic estimate still above the current stock price.

Will Vistra surprise investors in 2025 as it did this year? That will depend on how the company leverages the growing demand for energy for data centers and secures key deals with tech giants. Additionally, with a forward P/E ratio that’s nearly double the industry median, high expectations seem to already be priced in.