Investing in stocks can be a great way to grow your funds. Although it has a very high ceiling, it also has a pretty low floor: these days, all you need to start investing in the stock market is just a few dollars and an Internet connection. In this article, I will cover everything you need to know about how to make money in stocks, from the steps every beginner investor should take to more advanced strategies, as well as the common mistakes you should avoid.

Please remember that this article does not constitute investment advice and is posted for educational purposes only.

What Are Stocks?

Stocks represent shares of ownership in a company, making the stockholder a part owner of that business. When you buy individual stocks, you’re essentially buying a piece of that company’s future profits and growth. The value of these stocks, or stock prices, fluctuates based on how investors perceive the company’s prospects.

Companies issue stocks to raise capital for expansion, new projects, or to improve their financial health. This process is a fundamental aspect of how the stock market functions, providing a platform where stocks are bought and sold. Investing in stocks is considered one of the primary methods for individuals to grow their wealth over time. Unlike other asset classes, such as bonds or real estate, stocks have the potential for significant growth, but they also come with higher risk due to market volatility.

Types of Stocks

Stocks can be broadly categorized into two main types: common stocks and preferred stocks. Common stocks are the most prevalent form of stock that people invest in. Holders of common stocks have voting rights at shareholders’ meetings and may receive dividends, which are a share of the company’s profits. Preferred stocks, on the other hand, usually don’t provide voting rights, but they offer a higher claim on assets and earnings than common stocks; for example, dividends for preferred stocks are typically higher and paid out before those of common stocks.

Within these categories, stocks can also be classified based on the company’s characteristics, such as growth stocks and value stocks. Growth stocks are from companies expected to grow at an above-average rate compared to other companies. They reinvest their earnings into the business for expansion, so dividends are less common. Value stocks are those that investors believe are undervalued by the market. They are often companies with solid fundamentals that, for various reasons, are trading below what investors perceive to be their true market value.

How to Start Investing in Stocks

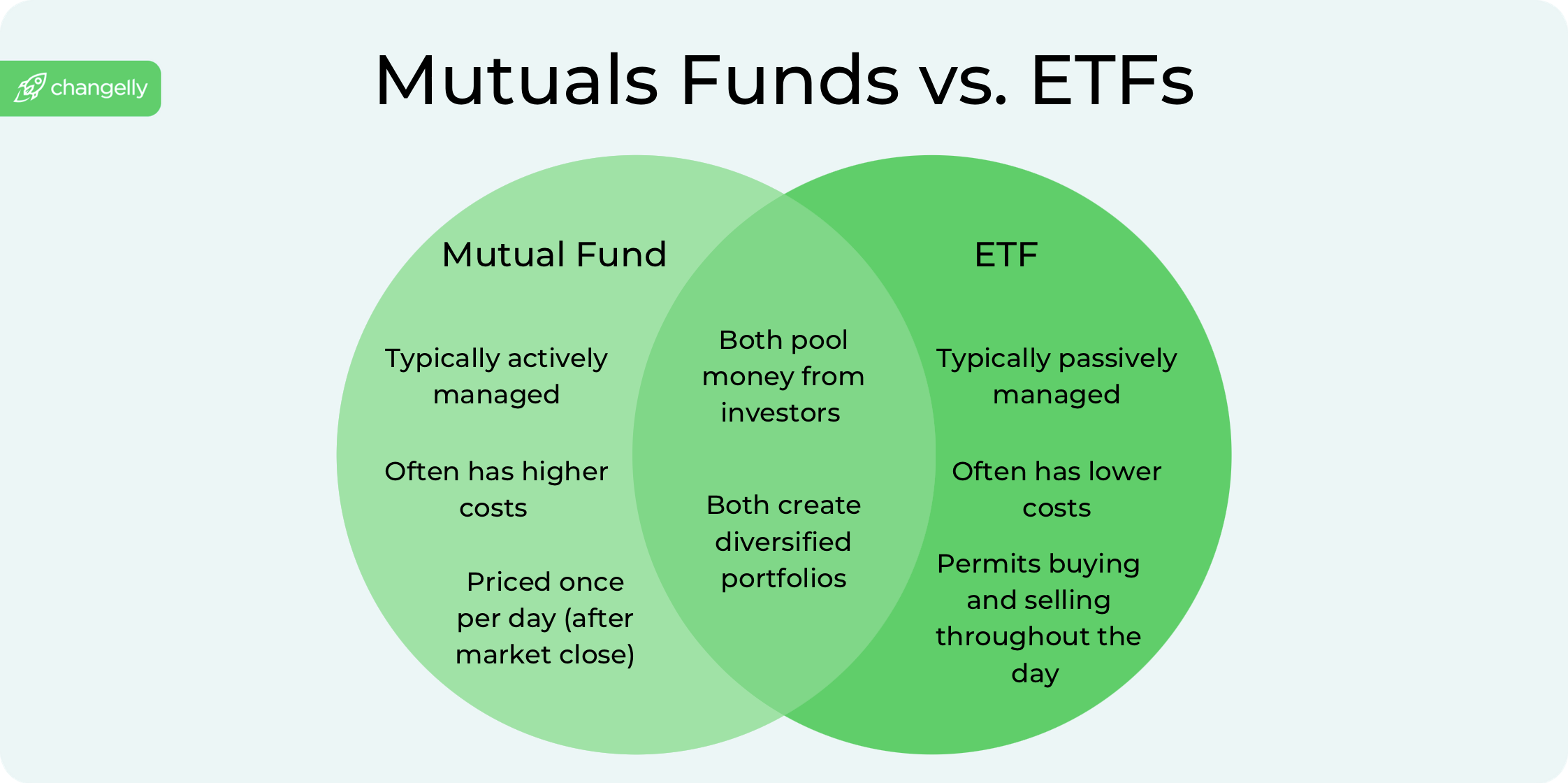

Starting your journey into stock investing can seem daunting at first, but with the right approach, it can be an exciting way to grow your wealth. First, it’s important to understand that stocks are shares of ownership in individual companies. When you buy stocks, you’re hoping that the companies you invest in will grow, increasing the value of your shares. Besides individual stocks, you can also invest in mutual funds and exchange-traded funds (ETFs), which allow you to buy a basket of stocks in one purchase. This can help diversify your portfolio and reduce risk.

Step 1: Define Your Investment Goals and Risk Tolerance

Identify your financial goals: Are you saving for retirement, a house, or perhaps your child’s education? Your goals will influence your investment strategy.

Understand how much risk you’re willing to take. Younger, long-term investors might tolerate more risk compared to those closer to retirement.

Step 2: Choose the Right Investment Account

For most, an online brokerage account is the best place to start. These platforms offer access to a wide range of stocks, mutual funds, and ETFs.

Consider starting with a tax-advantaged account like a traditional IRA, especially if you’re investing for retirement.

Step 3: Start With Mutual Funds or ETFs

Mutual funds and ETFs offer instant diversification, which is crucial for reducing risk. They allow you to invest in many stocks by purchasing a single share of the fund.

Look for funds that track the overall market for a start, as they tend to be more stable and have lower fees.

Step 4: Diversify Your Portfolio

As you get more comfortable, you can start adding individual stocks to your portfolio. Focus on industries and companies you understand.

Remember, a well-diversified portfolio includes a mix of sectors and asset classes to mitigate risk further.

Step 5: Monitor and Adjust Your Portfolio

Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance.

Be prepared to adjust your investments as your goals or the market changes.

Investing in stocks is not just about picking winners. It’s about setting clear goals, understanding your risk tolerance, and gradually building a diversified portfolio. While individual stocks can offer significant returns, they also come with higher risk. Starting with mutual funds or ETFs can be a safer way to get involved in the stock market, especially for beginners. Remember, investing is a marathon, not a sprint; patience and discipline are key to long-term success.

How to Invest in the Stock Market

Investing in the stock market involves a series of strategic actions aimed at growing your capital and achieving financial gains. Here are some general tips and steps that can get you started on your investment journey.

Selecting Stocks and Stock Funds

Choosing Individual Stocks: When you’re ready to invest, picking individual companies requires research into their financial health, market position, and potential for future growth. Look for companies with strong earnings growth, solid management teams, and competitive advantages in their industry. Investing in individual stocks offers the potential for high returns but comes with higher risk.

Investing in Stock Mutual Funds or ETFs: For those looking for diversification with a single transaction, stock mutual funds and ETFs are ideal. These funds pool money from many investors to buy a portfolio of stocks. Index funds, which track a specific index like the S&P 500, offer broad market exposure and are a favorite choice among long-term investors for their low fees and solid returns over time.

Making Your Investment

Using an Online Brokerage Account: To buy shares of stock or stock funds, you’ll need an account with an online broker. These platforms offer tools for research and trading, with varying levels of support and fees. Some brokers also offer the option to buy fractional shares, making it easier to invest in high-priced stocks with less money.

Placing Orders: You can buy stocks through different types of orders. A “market order” buys immediately at the current market price, while a “limit order” sets a specific price at which you’re willing to buy. Understanding these options helps you control your investment strategy more precisely.

Portfolio Management: Once you’ve made your investments, managing your stock portfolio involves monitoring the performance of your stocks or funds, keeping an eye on the market for changes, and adjusting your holdings as needed. This may include selling underperformers or buying additional shares of successful investments.

Reinvesting Dividends and Taking Advantage of Compound Interest

Dividend Reinvestment: Many stocks and mutual funds distribute dividends, which you can choose to reinvest by purchasing additional shares. This compounding effect can significantly increase your investment returns over time.

Evaluating Performance and Adjusting Your Strategy

Regularly review the performance of your investments in comparison to your goals and the broader market. Adjust your holdings to align with your investment strategy, taking into account changes in market conditions, economic indicators, and your financial goals.

Investing in the stock market is a dynamic and engaging process. By actively selecting stocks or funds, utilizing an online brokerage platform for trades, managing your portfolio with informed decisions, and leveraging the power of compounding through dividend reinvestment, you position yourself to capitalize on the potential financial rewards the stock market offers. Remember, while the goal is to make money, understanding the risks and maintaining a disciplined approach to investing is crucial for long-term success.

Making Money with Stocks: Advanced Strategies and Tips

Beyond the basics of selecting stocks and managing a portfolio, there are advanced strategies that successful investors use to increase their chances of making money from stocks. These approaches take into account market trends, company performance, and the broader economic landscape to make informed decisions. Here are some strategies and tips to help you maximize your investment returns:

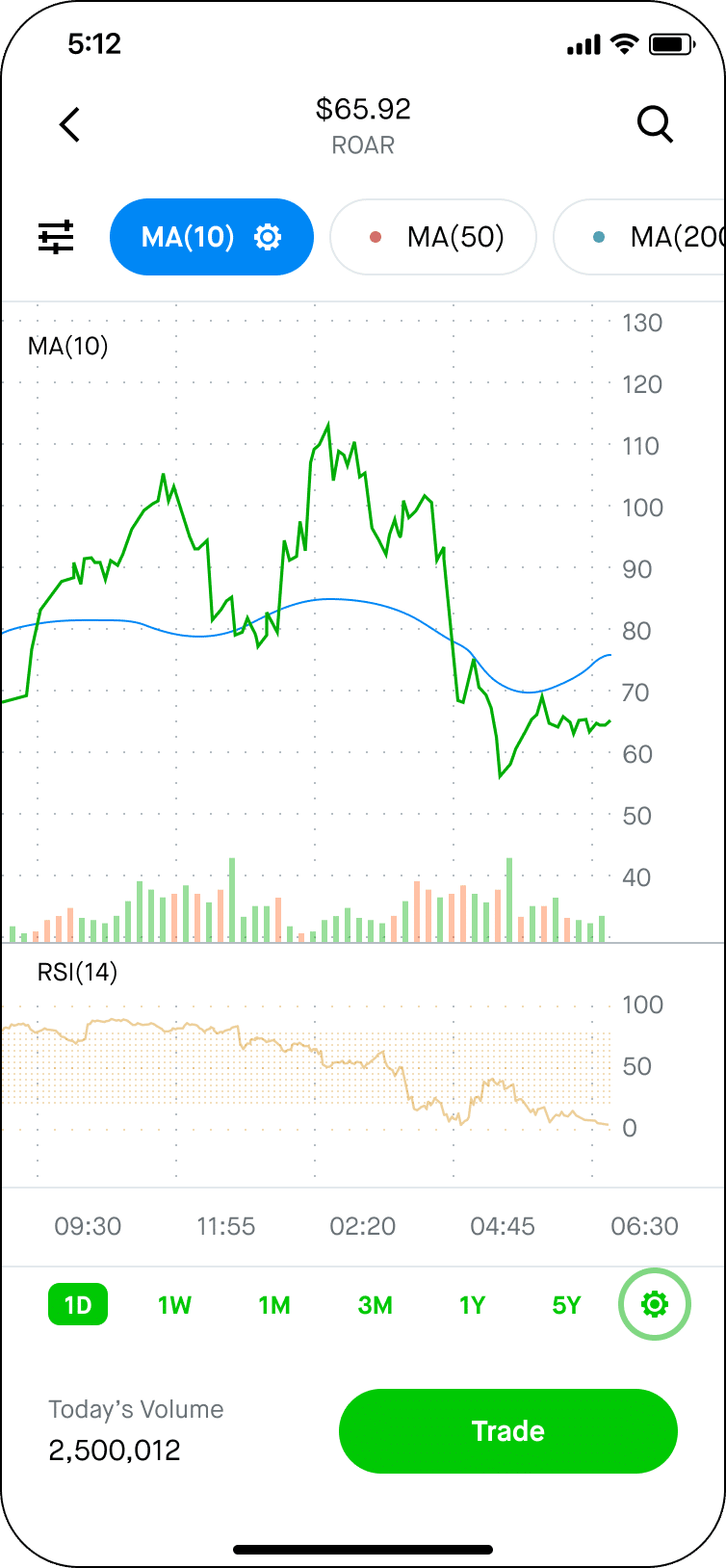

Understanding and Utilizing Stock Charts

Charts provide a visual representation of a stock’s past and present performance, offering insights into potential future movements. Look for patterns and trends that can indicate buying or selling opportunities. Use technical analysis to analyze stock charts to make predictions about future price movements based on past performance. While not foolproof, it can be a useful tool in your investment decision-making process.

Tax-Efficient Investing

Take advantage of tax benefits by utilizing tax-advantaged accounts like IRAs and 401(k)s to minimize the tax impact on your investment gains. Additionally, sell underperforming stocks to realize losses that can offset gains and reduce your tax liability.

Try Different Investment Strategies

There are many different ways to make money from stocks. For example, you can consider the buy-and-hold strategy — a long-term investment strategy that involves purchasing stocks and holding onto them for several years or decades, regardless of market volatility. It’s based on the belief that the stock market will generate positive returns over time. You can also diversify your portfolio by investing in various sectors. This can help you mitigate risk and capitalize on growth in different areas of the economy. Another avenue you can branch out into is IPOs — initial public offerings and secondary offerings can present opportunities for investors. However, they can also be risky, so it’s important to research these opportunities thoroughly before investing.

Investing in Stocks: Extra Tips

Review your investment strategy regularly, as your financial situation and goals can change over time.

Set and adjust your time horizon — your investment strategy should reflect the amount of time you plan to stay invested.

Use stop-loss orders to minimize potential losses.

Rebalance your portfolio annually to maintain your desired asset allocation.

Consider dividend reinvestment plans (DRIPs) to automatically reinvest dividends, compounding your investment returns.

Keep an emergency fund to avoid having to sell stocks in a down market.

Common Mistakes to Avoid When Investing in Stocks

No matter whether you’re a novice stock trader or have been navigating the stock exchange for years, there are common mistakes that can hinder your success. By identifying and avoiding these errors, individual investors can improve their chances of making money from stocks. Here are some critical missteps to watch out for:

Chasing high returns without considering additional risk: High returns often come with high risk. It’s essential to balance the lure of potential gains with the risk you’re willing to take, especially with volatile assets like small-cap stocks.

Ignoring the importance of diversification: Relying too much on a single stock, sector, or asset class can expose your investment portfolio to unnecessary risk. Diversifying across various sectors, including dividend stocks and stock mutual funds, can help spread risk.

Neglecting the investment’s time horizon: Your investment strategy should align with your financial goals and the time frame you have to achieve them. Short-term market fluctuations matter less for long-term investors, who can often ride out volatility.

Overreacting to short-term market volatility: The stock market is inherently volatile, and share prices fluctuate. Making hasty decisions in response to short-term movements can jeopardize long-term gains.

Overlooking fees and expenses: Fees can eat into your returns over time. Pay attention to transaction fees, fund management fees, and other costs associated with your brokerage account (e.g., Charles Schwab, Vanguard).

Attempting to time the market: Trying to predict the best times to buy and sell is notoriously difficult, even for professional investors. A more reliable strategy is regular, disciplined investing, regardless of market conditions.

By being aware of these common mistakes, individual investors can take steps to avoid them, making more informed financial decisions that align with their investment goals and risk tolerance. Remember, successful investing requires a mix of diligence, patience, and continuous learning. Whether you’re investing in dividend stocks, exploring small-cap stocks, or building a diversified portfolio with stock mutual funds, staying informed and avoiding these pitfalls can help you navigate the complexities of the stock market more effectively.

FAQ: How to Make Money in Stocks

How do beginners make money in the stock market?

Beginners can make money in the stock market by starting with investment accounts that require low initial investments, such as online brokers or robo-advisors. Investing in mutual funds or exchange-traded funds (ETFs) can also be a good start, as they offer diversification with just a few dollars. Consulting a financial advisor for personalized advice can further enhance investment decisions.

Can you make a lot of money in stocks?

Yes, it’s possible to make a lot of money in stocks, especially if you invest wisely over a long period. Successful stock investments often involve a mix of diversified assets, patience, and a well-researched strategy. However, the stock market also carries the risk of losses.

Can I make $100 a day with stocks?

Making $100 a day with stocks is possible but highly variable and depends on the amount of capital invested and market conditions. Such short-term trading requires significant knowledge, experience, and risk tolerance, as it often involves speculative strategies.

How much money do I need to invest to make $1,000 a month?

The amount needed to invest to make $1,000 a month depends on the expected return rate. For example, to generate $12,000 annually with a 5% return, you would need to invest approximately $240,000. This calculation varies based on the return rate and does not account for taxes or fees.

What are the best brokers for stock trading?

The best brokers for stock trading offer low fees, a user-friendly platform, and a range of investment options. Popular choices include online brokers like Charles Schwab, Vanguard, and Fidelity. These platforms cater to both beginners and experienced traders with various tools for wealth management and retirement accounts.

Is stock investing safe?

Stock investing involves risk, including the potential loss of principal. However, diversifying your investments across different asset classes and sectors can mitigate some risks. It’s also safer to invest with a long-term perspective rather than trying to make quick profits from short-term market fluctuations. Consulting financial advisors for tailored advice can also help navigate the risks associated with stock investing.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.