Quick Take

In the week preceding the much-anticipated Bitcoin halving on April 20, transaction fees for Bitcoin exceeded those of Ethereum; this trend persisted until April 27, according to Glassnode data.

CryptoSlate meticulously tracked fee trends across both blockchains before, during, and after the halving. Data unveiled a notable but temporary spike in Bitcoin fees, fueled by speculative activity surrounding Runes.

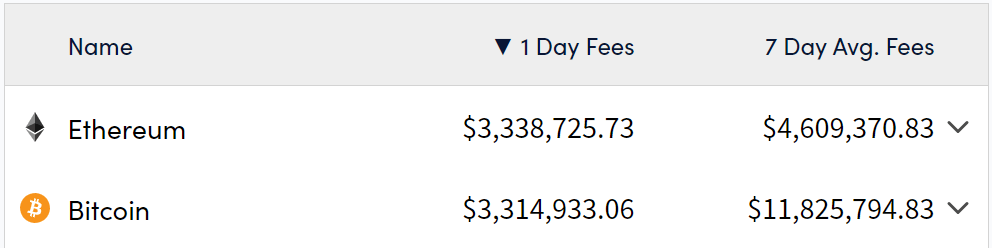

However, by April 28, Ethereum fees had slightly outpaced Bitcoin, hitting $3,339 million compared to $3,315 million for Bitcoin. Bitcoin’s 7-day average fees remained elevated at around $11.8 million, according to Cryptofees.

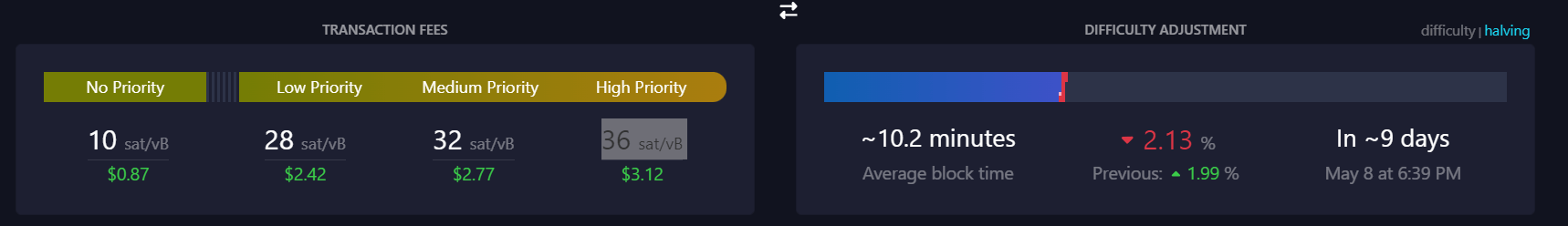

The mempool.space platform, which tracks Bitcoin transaction fees, indicated that high-priority transactions had dropped to around 36 sat/vB, roughly $3.12 at current prices.

Meanwhile, as anticipated, Bitcoin’s mining difficulty is expected to drop roughly 2% by the next adjustment in 9 days. The average block time currently stands at approximately 10.2 minutes, slightly above the targeted 10 minutes.

As the post-halving dust settles, fee markets appear normalizing, with Runes-driven speculation fading into the rearview mirror.