Bitcoin Overview

Our real-time BTC to USD price update shows the current Bitcoin price as $63,347 USD.

Our most recent Bitcoin price forecast indicates that its value will increase by 12.71% and reach $71,397 by May 08, 2024.

Our technical indicators signal about the Neutral Bullish 61% market sentiment on Bitcoin, while the Fear & Greed Index is displaying a score of 71 (Greed).

Over the last 30 days, Bitcoin has had 17/30 (57%) green days and 5.03% price volatility.

Bitcoin (BTC) Technical Overview

When discussing future trading opportunities of digital assets, it is essential to pay attention to market sentiments.

Bitcoin Profit Calculator

Profit calculation please wait…

Bitcoin (BTC) Price Prediction For Today, Tomorrow and Next 30 Days

Date

Price

Change

May 07, 2024$63,9090.89%May 08, 2024$67,6526.8%May 09, 2024$71,39712.71%May 10, 2024$72,27614.1%May 11, 2024$72,77814.89%May 12, 2024$73,48516%May 13, 2024$74,25517.22%May 14, 2024$74,91018.25%May 15, 2024$75,50419.19%May 16, 2024$76,08520.11%May 17, 2024$76,65721.01%May 18, 2024$76,94921.47%May 19, 2024$76,85521.32%May 20, 2024$76,36120.54%May 21, 2024$74,95318.32%May 22, 2024$73,70316.35%May 23, 2024$73,14415.47%May 24, 2024$72,64914.68%May 25, 2024$72,99415.23%May 26, 2024$73,33915.77%May 27, 2024$76,86521.34%May 28, 2024$80,53927.14%May 29, 2024$82,27629.88%May 30, 2024$83,64032.03%May 31, 2024$84,12932.81%June 01, 2024$84,28333.05%June 02, 2024$84,13632.82%June 03, 2024$83,79532.28%June 04, 2024$83,57031.92%June 05, 2024$83,46531.76%

Bitcoin Prediction Table

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2040

2050

May

$63,909

$73,774.50

$83,640

June

$63,557.53

$74,698.97

$85,840.41

July

$62,122.56

$65,068.50

$68,014.43

August

$58,496.51

$64,189.40

$69,882.29

September

$55,342.77

$70,364.99

$85,387.20

October

$55,563.46

$69,644.44

$83,725.41

November

$42,659.12

$58,984.48

$75,309.84

December

$45,898.71

$49,098.14

$52,297.57

January

$47,113.85

$49,165.32

$51,216.79

All Time

$54,962.61

$63,887.64

$72,812.66

Choose a year

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2040

2050

Bitcoin Historical

According to the latest data gathered, the current price of Bitcoin is $$63,388.56, and BTC is presently ranked No. 1 in the entire crypto ecosystem. The circulation supply of Bitcoin is $1,248,424,948,687.35, with a market cap of 19,694,800 BTC.

In the past 24 hours, the crypto has increased by $963.51 in its current value.

For the last 7 days, BTC has been in a good upward trend, thus increasing by 0.77%. Bitcoin has shown very strong potential lately, and this could be a good opportunity to dig right in and invest.

During the last month, the price of BTC has increased by 7%, adding a colossal average amount of $4,437.20 to its current value. This sudden growth means that the coin can become a solid asset now if it continues to grow.

Bitcoin Price Prediction 2024

According to the technical analysis of Bitcoin prices expected in 2024, the minimum cost of Bitcoin will be $$42,659.12. The maximum level that the BTC price can reach is $$64,249.77. The average trading price is expected around $$85,840.41.

BTC Price Forecast for May 2024

Based on the price fluctuations of Bitcoin at the beginning of 2023, crypto experts expect the average BTC rate of $$73,774.50 in May 2024. Its minimum and maximum prices can be expected at $$63,909 and at $$83,640, respectively.

June 2024: Bitcoin Price Forecast

Cryptocurrency experts are ready to announce their forecast for the BTC price in June 2024. The minimum trading cost might be $$63,557.53, while the maximum might reach $$85,840.41 during this month. On average, it is expected that the value of Bitcoin might be around $$74,698.97.

BTC Price Forecast for July 2024

Crypto analysts have checked the price fluctuations of Bitcoin in 2023 and in previous years, so the average BTC rate they predict might be around $$65,068.50 in July 2024. It can drop to $$62,122.56 as a minimum. The maximum value might be $$68,014.43.

August 2024: Bitcoin Price Forecast

In the middle of the year 2023, the BTC price will be traded at $$64,189.40 on average. August 2024 might also witness an increase in the Bitcoin value to $$69,882.29. It is assumed that the price will not drop lower than $$58,496.51 in August 2024.

BTC Price Forecast for September 2024

Crypto experts have analyzed Bitcoin prices in 2023, so they are ready to provide their estimated trading average for September 2024 — $$70,364.99. The lowest and peak BTC rates might be $$55,342.77 and $$85,387.20.

October 2024: Bitcoin Price Forecast

Crypto analysts expect that at the end of summer 2023, the BTC price will be around $$69,644.44. In October 2024, the Bitcoin cost may drop to a minimum of $$55,563.46. The expected peak value might be $$83,725.41 in October 2024.

BTC Price Forecast for November 2024

Having analyzed Bitcoin prices, cryptocurrency experts expect that the BTC rate might reach a maximum of $$75,309.84 in November 2024. It might, however, drop to $$42,659.12. For November 2024, the forecasted average of Bitcoin is nearly $$58,984.48.

December 2024: Bitcoin Price Forecast

In the middle of autumn 2023, the Bitcoin cost will be traded at the average level of $$49,098.14. Crypto analysts expect that in December 2024, the BTC price might fluctuate between $$45,898.71 and $$52,297.57.

BTC Price Forecast for January 2025

Market experts expect that in January 2025, the Bitcoin value will not drop below a minimum of $$47,113.85. The maximum peak expected this month is $$51,216.79. The estimated average trading value will be at the level of $$49,165.32.

Bitcoin Price Prediction 2025

After the analysis of the prices of Bitcoin in previous years, it is assumed that in 2025, the minimum price of Bitcoin will be around $$118,755. The maximum expected BTC price may be around $$142,086. On average, the trading price might be $$122,185 in 2025.

Month

Minimum Price

Average Price

Maximum Price

January 2025

$49,000.44

$88,869.13

$70,736.12

February 2025

$55,341.77

$91,897.84

$77,222.48

March 2025

$61,683.09

$94,926.56

$83,708.83

April 2025

$68,024.41

$97,955.27

$90,195.18

May 2025

$74,365.74

$100,983.99

$96,681.53

June 2025

$80,707.06

$104,012.71

$103,167.89

July 2025

$87,048.38

$107,041.42

$109,654.24

August 2025

$93,389.71

$110,070.14

$116,140.59

September 2025

$99,731.03

$113,098.85

$122,626.94

October 2025

$106,072.35

$116,127.57

$129,113.30

November 2025

$112,413.68

$119,156.28

$135,599.65

December 2025

$118,755

$122,185

$142,086

Bitcoin Price Prediction 2026

Based on the technical analysis by cryptocurrency experts regarding the prices of Bitcoin, in 2026, BTC is expected to have the following minimum and maximum prices: about $$174,376 and $$202,880, respectively. The average expected trading cost is $$179,262.

Month

Minimum Price

Average Price

Maximum Price

January 2026

$123,390.08

$126,941.42

$147,152.17

February 2026

$128,025.17

$131,697.83

$152,218.33

March 2026

$132,660.25

$136,454.25

$157,284.50

April 2026

$137,295.33

$141,210.67

$162,350.67

May 2026

$141,930.42

$145,967.08

$167,416.83

June 2026

$146,565.50

$150,723.50

$172,483

July 2026

$151,200.58

$155,479.92

$177,549.17

August 2026

$155,835.67

$160,236.33

$182,615.33

September 2026

$160,470.75

$164,992.75

$187,681.50

October 2026

$165,105.83

$169,749.17

$192,747.67

November 2026

$169,740.92

$174,505.58

$197,813.83

December 2026

$174,376

$179,262

$202,880

Bitcoin Price Prediction 2027

The experts in the field of cryptocurrency have analyzed the prices of Bitcoin and their fluctuations during the previous years. It is assumed that in 2027, the minimum BTC price might drop to $$248,295, while its maximum can reach $$298,850. On average, the trading cost will be around $$255,465.

Month

Minimum Price

Average Price

Maximum Price

January 2027

$180,535.92

$185,612.25

$210,877.50

February 2027

$186,695.83

$191,962.50

$218,875

March 2027

$192,855.75

$198,312.75

$226,872.50

April 2027

$199,015.67

$204,663

$234,870

May 2027

$205,175.58

$211,013.25

$242,867.50

June 2027

$211,335.50

$217,363.50

$250,865

July 2027

$217,495.42

$223,713.75

$258,862.50

August 2027

$223,655.33

$230,064

$266,860

September 2027

$229,815.25

$236,414.25

$274,857.50

October 2027

$235,975.17

$242,764.50

$282,855

November 2027

$242,135.08

$249,114.75

$290,852.50

December 2027

$248,295

$255,465

$298,850

Bitcoin Price Prediction 2028

Based on the analysis of the costs of Bitcoin by crypto experts, the following maximum and minimum BTC prices are expected in 2028: $$430,664 and $$361,017. On average, it will be traded at $$371,235.

Month

Minimum Price

Average Price

Maximum Price

January 2028

$257,688.50

$265,112.50

$309,834.50

February 2028

$267,082

$274,760

$320,819

March 2028

$276,475.50

$284,407.50

$331,803.50

April 2028

$285,869

$294,055

$342,788

May 2028

$295,262.50

$303,702.50

$353,772.50

June 2028

$304,656

$313,350

$364,757

July 2028

$314,049.50

$322,997.50

$375,741.50

August 2028

$323,443

$332,645

$386,726

September 2028

$332,836.50

$342,292.50

$397,710.50

October 2028

$342,230

$351,940

$408,695

November 2028

$351,623.50

$361,587.50

$419,679.50

December 2028

$361,017

$371,235

$430,664

Bitcoin Price Prediction 2029

Crypto experts are constantly analyzing the fluctuations of Bitcoin. Based on their predictions, the estimated average BTC price will be around $$549,995. It might drop to a minimum of $$535,145, but it still might reach $$626,526 throughout 2029.

Month

Minimum Price

Average Price

Maximum Price

January 2029

$375,527.67

$386,131.67

$446,985.83

February 2029

$390,038.33

$401,028.33

$463,307.67

March 2029

$404,549

$415,925

$479,629.50

April 2029

$419,059.67

$430,821.67

$495,951.33

May 2029

$433,570.33

$445,718.33

$512,273.17

June 2029

$448,081

$460,615

$528,595

July 2029

$462,591.67

$475,511.67

$544,916.83

August 2029

$477,102.33

$490,408.33

$561,238.67

September 2029

$491,613

$505,305

$577,560.50

October 2029

$506,123.67

$520,201.67

$593,882.33

November 2029

$520,634.33

$535,098.33

$610,204.17

December 2029

$535,145

$549,995

$626,526

Bitcoin Price Prediction 2030

Every year, cryptocurrency experts prepare forecasts for the price of Bitcoin. It is estimated that BTC will be traded between $$754,110 and $$912,127 in 2030. Its average cost is expected at around $$776,109 during the year.

Month

Minimum Price

Average Price

Maximum Price

January 2030

$553,392.08

$568,837.83

$650,326.08

February 2030

$571,639.17

$587,680.67

$674,126.17

March 2030

$589,886.25

$606,523.50

$697,926.25

April 2030

$608,133.33

$625,366.33

$721,726.33

May 2030

$626,380.42

$644,209.17

$745,526.42

June 2030

$644,627.50

$663,052

$769,326.50

July 2030

$662,874.58

$681,894.83

$793,126.58

August 2030

$681,121.67

$700,737.67

$816,926.67

September 2030

$699,368.75

$719,580.50

$840,726.75

October 2030

$717,615.83

$738,423.33

$864,526.83

November 2030

$735,862.92

$757,266.17

$888,326.92

December 2030

$754,110

$776,109

$912,127

Bitcoin Price Prediction 2031

Cryptocurrency analysts are ready to announce their estimations of the Bitcoin’s price. The year 2031 will be determined by the maximum BTC price of $$1,324,089. However, its rate might drop to around $$1,096,457. So, the expected average trading price is $$1,127,502.

Month

Minimum Price

Average Price

Maximum Price

January 2031

$782,638.92

$805,391.75

$946,457.17

February 2031

$811,167.83

$834,674.50

$980,787.33

March 2031

$839,696.75

$863,957.25

$1,015,117.50

April 2031

$868,225.67

$893,240

$1,049,447.67

May 2031

$896,754.58

$922,522.75

$1,083,777.83

June 2031

$925,283.50

$951,805.50

$1,118,108

July 2031

$953,812.42

$981,088.25

$1,152,438.17

August 2031

$982,341.33

$1,010,371

$1,186,768.33

September 2031

$1,010,870.25

$1,039,653.75

$1,221,098.50

October 2031

$1,039,399.17

$1,068,936.50

$1,255,428.67

November 2031

$1,067,928.08

$1,098,219.25

$1,289,758.83

December 2031

$1,096,457

$1,127,502

$1,324,089

Bitcoin Price Prediction 2032

After years of analysis of the Bitcoin price, crypto experts are ready to provide their BTC cost estimation for 2032. It will be traded for at least $$1,577,446, with the possible maximum peaks at $$1,906,149. Therefore, on average, you can expect the BTC price to be around $$1,622,547 in 2032.

Month

Minimum Price

Average Price

Maximum Price

January 2032

$1,136,539.42

$1,168,755.75

$1,372,594

February 2032

$1,176,621.83

$1,210,009.50

$1,421,099

March 2032

$1,216,704.25

$1,251,263.25

$1,469,604

April 2032

$1,256,786.67

$1,292,517

$1,518,109

May 2032

$1,296,869.08

$1,333,770.75

$1,566,614

June 2032

$1,336,951.50

$1,375,024.50

$1,615,119

July 2032

$1,377,033.92

$1,416,278.25

$1,663,624

August 2032

$1,417,116.33

$1,457,532

$1,712,129

September 2032

$1,457,198.75

$1,498,785.75

$1,760,634

October 2032

$1,497,281.17

$1,540,039.50

$1,809,139

November 2032

$1,537,363.58

$1,581,293.25

$1,857,644

December 2032

$1,577,446

$1,622,547

$1,906,149

Bitcoin Price Prediction 2033

Cryptocurrency analysts are ready to announce their estimations of the Bitcoin’s price. The year 2033 will be determined by the maximum BTC price of $$2,787,136. However, its rate might drop to around $$2,417,673. So, the expected average trading price is $$2,498,801.

Month

Minimum Price

Average Price

Maximum Price

January 2033

$1,647,464.92

$1,695,568.17

$1,979,564.58

February 2033

$1,717,483.83

$1,768,589.33

$2,052,980.17

March 2033

$1,787,502.75

$1,841,610.50

$2,126,395.75

April 2033

$1,857,521.67

$1,914,631.67

$2,199,811.33

May 2033

$1,927,540.58

$1,987,652.83

$2,273,226.92

June 2033

$1,997,559.50

$2,060,674

$2,346,642.50

July 2033

$2,067,578.42

$2,133,695.17

$2,420,058.08

August 2033

$2,137,597.33

$2,206,716.33

$2,493,473.67

September 2033

$2,207,616.25

$2,279,737.50

$2,566,889.25

October 2033

$2,277,635.17

$2,352,758.67

$2,640,304.83

November 2033

$2,347,654.08

$2,425,779.83

$2,713,720.42

December 2033

$2,417,673

$2,498,801

$2,787,136

Bitcoin Price Prediction 2040

According to the technical analysis of Bitcoin prices expected in 2040, the minimum cost of Bitcoin will be $$3,773,189. The maximum level that the BTC price can reach is $$4,123,022. The average trading price is expected around $$3,898,129.

Month

Minimum Price

Average Price

Maximum Price

January 2040

$2,530,632.67

$2,615,411.67

$2,898,459.83

February 2040

$2,643,592.33

$2,732,022.33

$3,009,783.67

March 2040

$2,756,552

$2,848,633

$3,121,107.50

April 2040

$2,869,511.67

$2,965,243.67

$3,232,431.33

May 2040

$2,982,471.33

$3,081,854.33

$3,343,755.17

June 2040

$3,095,431

$3,198,465

$3,455,079

July 2040

$3,208,390.67

$3,315,075.67

$3,566,402.83

August 2040

$3,321,350.33

$3,431,686.33

$3,677,726.67

September 2040

$3,434,310

$3,548,297

$3,789,050.50

October 2040

$3,547,269.67

$3,664,907.67

$3,900,374.33

November 2040

$3,660,229.33

$3,781,518.33

$4,011,698.17

December 2040

$3,773,189

$3,898,129

$4,123,022

Bitcoin Price Prediction 2050

After the analysis of the prices of Bitcoin in previous years, it is assumed that in 2050, the minimum price of Bitcoin will be around $$4,872,662. The maximum expected BTC price may be around $$5,222,494. On average, the trading price might be $$5,022,590 in 2050.

Month

Minimum Price

Average Price

Maximum Price

January 2050

$3,864,811.75

$3,991,834.08

$4,214,644.67

February 2050

$3,956,434.50

$4,085,539.17

$4,306,267.33

March 2050

$4,048,057.25

$4,179,244.25

$4,397,890

April 2050

$4,139,680

$4,272,949.33

$4,489,512.67

May 2050

$4,231,302.75

$4,366,654.42

$4,581,135.33

June 2050

$4,322,925.50

$4,460,359.50

$4,672,758

July 2050

$4,414,548.25

$4,554,064.58

$4,764,380.67

August 2050

$4,506,171

$4,647,769.67

$4,856,003.33

September 2050

$4,597,793.75

$4,741,474.75

$4,947,626

October 2050

$4,689,416.50

$4,835,179.83

$5,039,248.67

November 2050

$4,781,039.25

$4,928,884.92

$5,130,871.33

December 2050

$4,872,662

$5,022,590

$5,222,494

What Is Bitcoin (BTC)?

Bitcoin, Bitcoin… Is there anything new to say about this cryptocurrency at this point? Even people who have zero interest in the industry have heard its name. As the number one cryptocurrency, it enjoys unimaginably high prices (up to $73K), a lot of attention, and, of course, much scrutiny.

Bitcoin, alongside the rest of the cryptocurrency market, is known for its ability to overcome any challenges and have strong comebacks despite everyone writing it off. Various financial experts have been predicting that the Bitcoin bubble will pop “in the near future” every month without fail for the past eight or so years. And yet, the coin still remains on top, and BTC investors enjoy high profits, patiently waiting for yet another meteoric BTC price rise.

However, the crypto industry is rapidly changing, and some crypto enthusiasts are starting to doubt whether Bitcoin is still worth investing in.

Please note that this is our long-term Bitcoin price prediction. This article does not constitute financial advice, and we are not investment advisors.

Bitcoin is the first cryptocurrency that was created back in 2009. It is a decentralized digital currency that uses blockchain technology to facilitate trustless peer-to-peer transactions. BTC has the proof-of-work consensus mechanism, which means it relies on Bitcoin miners to secure its network.

In recent years, Bitcoin has been one of the most popular assets for investment: not only can it be extremely profitable due to the high volatility of the cryptocurrency market, but it is also very easy to invest in. All one needs to get Bitcoin is an Internet connection.

What Affects the Value of Bitcoin?

Numerous factors can influence Bitcoin’s price movements. Unlike many altcoins, Bitcoin often sets the trend for the cryptocurrency market, showing less dependency on the performance of other digital currencies. Nonetheless, Bitcoin remains sensitive to universal market influences such as shifts in interest rates or significant developments in the crypto sector, particularly those affecting major players like Ethereum or Shiba Inu. For example, when Ethereum announced The Merge phase of its transition to a proof-of-stake model, it also influenced the perception and value of Bitcoin.

Bitcoin, like any asset, is susceptible to news specifically about itself, the broader crypto exchanges, or blockchain advancements. For instance, crypto valuations generally surge with announcements of widespread adoption or innovative technological advancements. A prime example is when major corporations like Tesla, Microsoft, Starbucks, etc. announced they would start accepting Bitcoin as payment, leading to a sharp increase in its value. Conversely, any hint of uncertainty, like rumors of regulatory crackdowns, can influence the Bitcoin market, too, and swiftly reduce its value.

External, non-crypto news can also play a crucial role in shaping Bitcoin’s price. A notable example was observed in the spring of 2020, when the global economic uncertainty due to the pandemic heated up interest in Bitcoin as a potential safe haven, boosting its price significantly. Therefore, keeping an eye on stock market trends can provide deeper insights into the current state of Bitcoin.

Additionally, environmental news, such as intense scrutiny over the energy consumption of mining operations, is another area that prospective or current Bitcoin investors should monitor closely, as it increasingly influences market dynamics.

History of Bitcoin

Bitcoin’s price history is known to most crypto enthusiasts. From being ultimately nearly worthless, this coin has grown to become one of the biggest assets in the world. At its height, Bitcoin’s market cap was even higher than that of several established businesses.

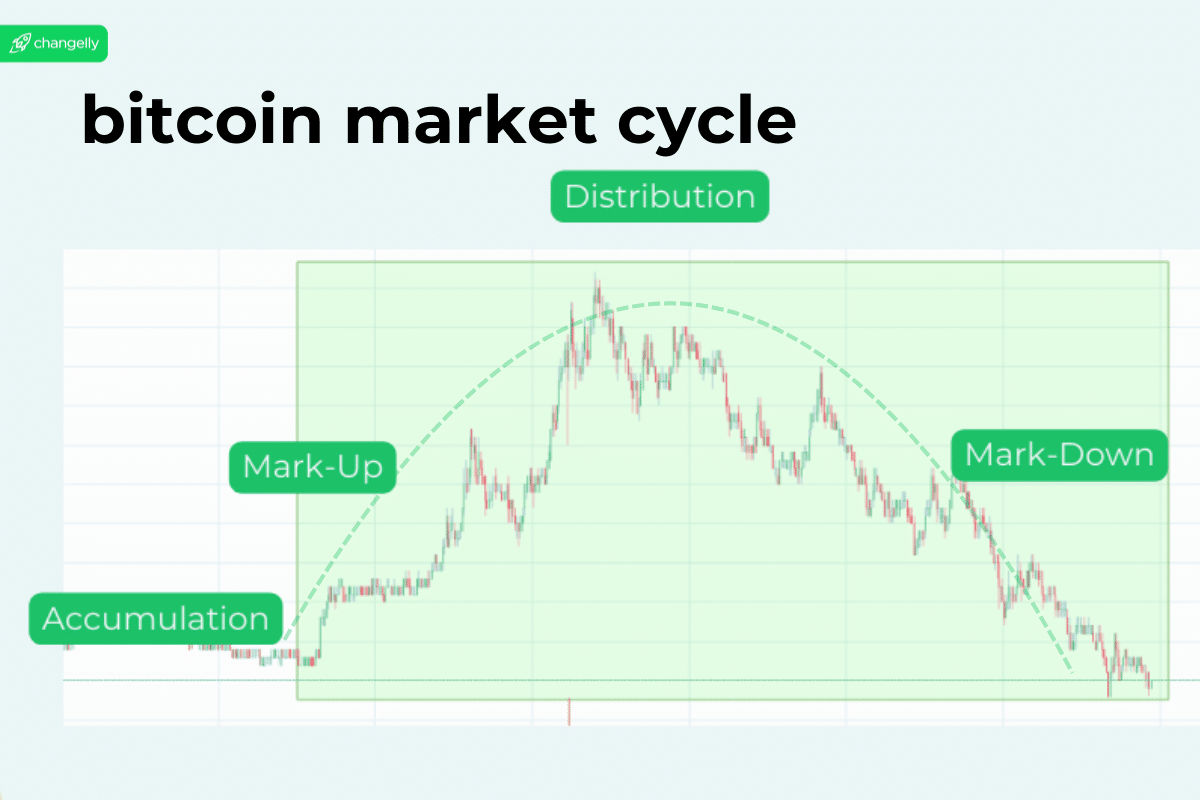

Let’s take a brief look at the Bitcoin price chart.

Upon looking at this chart, one thing that immediately becomes apparent is that Bitcoin’s price cycles keep on shortening. Additionally, despite the coin regularly losing value, the average value of Bitcoin keeps increasing. This shows a positive trend for the future.

“Will Bitcoin go back up?” is an evergreen question in the crypto market. The truth is, no matter how hard we study BTC price history and trends, we would not be able to predict this accurately. However, we can still consider these factors as well as today’s Bitcoin news to make a tentative prediction.

Bitcoin’s crypto market cap is still the highest in the industry, and it still has the most recognition. Its circulating supply is slowly approaching its total supply but there’s still a long way to go till we reach a point where there will be no new Bitcoins released.

Overall, Bitcoin price history shows us that there’s still room for this asset to grow even if there is a bear market.

Please note that this does not constitute investment advice.

Will Bitcoin Go Back Up?

The future trajectory of Bitcoin’s price is constantly under scrutiny, influenced by various macroeconomic factors and significant events within the cryptocurrency sector.

In 2024, Bitcoin has already experienced a notable surge, updating its all-time high to over $73,700.

This March also earned its place in the history books. The SEC’s green light for these spot Bitcoin ETFs represents a huge milestone for the crypto community, potentially broadening investor access and confidence.

Another key event was the Bitcoin block reward halving that occurred in April 2024. This event, often associated with previous price surges, suggests a bullish momentum could be underway.

Experts within the industry are forecasting a new growth cycle in the crypto market, potentially peaking between 2024 and 2025. This expectation aligns with the four-year market cycle theory, which coincides with the last bull run in 2021.

However, external factors such as global news and events could impact Bitcoin’s price trajectory.

An important forthcoming event is the 2024 presidential election, where Donald Trump’s potential re-election is viewed by some as a positive catalyst for Bitcoin’s value. The Trump administration could foster a favorable environment for Bitcoin and other digital assets through more relaxed regulations.

Yet, despite these optimistic developments, the long-term prospects of the cryptocurrency market remain under examination. The growing introduction of crypto-related products contrasts with expert skepticism, often due to strict global regulations and public hesitance towards new technologies, largely stemming from misunderstandings or fears.

Bitcoin remains a straightforward digital currency by design; all the same its slow adaptation and reliance on the environmentally taxing proof-of-work (PoW) consensus algorithm might hinder its appeal compared to more versatile cryptocurrency ecosystems.

Given these dynamics, the question persists: Can Bitcoin recover and surpass its previous highs? Its history of resilience suggests a potential for rebound, aligning with analysts optimistic about the near future. As we watch Bitcoin’s numbers, it’s clear that the cryptocurrency stands as a remarkable financial technology with the potential to impact the global economy, promising substantial projected growth and affirming its status as a pivotal global currency.

Bitcoin Price Predictions by Experts

Despite Bitcoin trading lower than $70,000 after renewing its ATH, investor sentiment is generally bullish, suggesting an optimistic outlook for future price increases.

Anthony Scaramucci of SkyBridge Capital sees Bitcoin peaking at $170,000 within the next year, marking a significant uptick in the current cycle.

Technopedia has adjusted its outlook for Bitcoin in 2024, predicting a new all-time high (ATH) of $85,000, with potential lows around $38,000. They expect the average price to hover around $60,000, revising earlier predictions of a peak at $98,000 to a more conservative estimate.

MicroStrategy’s Michael Saylor anticipates a “supply shock” from the Bitcoin halving, which he believes will drastically reduce the amount of Bitcoin available from miners and trigger a substantial price increase. Citing historical performance post-halving, he suggests a similar bullish trend could follow this recent event.

Tim Draper of Draper Associates projects a rise to $250,000 by July, sharing a highly optimistic view.

Similarly, Marshall Beard, CEO of Gemini exchange, predicts a rally to $150,000 by the end of the year.

Tom Lee of Fundstrat Global Advisors also foresees a potential rise to $150,000 in the short term and even speculates that Bitcoin could escalate to $500,000 within 5 years.

Ark Invest’s Cathie Wood envisions Bitcoin reaching $1 million within the next five years, an ambitious projection that underscores her confidence in Bitcoin’s long-term growth potential.

Digital Coin Price suggests an average price of $130,185.47 for 2024, with peaks potentially reaching $136,867.90, and anticipates a new high of $160,457.56 in 2025.

Conversely, more conservative views from sources like Wallet Investor anticipate a possible rise to $75,867.21 in 5 years.

These bullish predictions are underpinned by Bitcoin’s finite supply and independence from external economic factors. Its growing acceptance and technological advancements, despite the evolving regulatory landscapes, bolster its investment appeal.

The Bearish Scenario

At the time of writing, the cryptocurrency industry largely maintains a positive view on Bitcoin, making it challenging to find notable bearish projections. However, two primary concerns could negatively influence Bitcoin’s price.

Firstly, Bitcoin’s substantial energy consumption continues to draw criticism, posing a potential threat to its market value. Secondly, the evolving regulatory landscape, particularly concerning anti-money laundering (AML) and Know Your Customer (KYC) laws, presents significant challenges that trouble investors.

If Bitcoin’s price crashes, then the values of other cryptocurrencies are likely to follow suit.

Is Bitcoin a Good Investment?

Read also: What if I Invest $100 in Bitcoin Today?

No matter if it’s in a down- or uptrend, Bitcoin is almost always predicted to keep rising in the future. So, it can be a good investment. However, please DYOR and carefully consider the risks before investing in BTC or any other cryptocurrency.

Our Bitcoin price prediction is rather conservative and does not take into account any random media hype or unexpected regulations that may happen in the near future — these factors are too unpredictable. However, if you’re considering investing in Bitcoin, you need to make sure you’re ready for its price to fluctuate wildly.

Bitcoin is less risky than other cryptocurrencies, but it is still fairly unstable and unpredictable in comparison to traditional investment avenues like the stock market.

Is Bitcoin still safe to invest in?

Investing in Bitcoin carries serious risks due to its high volatility. It’s advisable only for those with a high risk tolerance, a stable financial foundation, and the capacity to absorb potential losses. Before investing, ensure you fully understand what you’re getting into and conduct thorough research.If you’re new to cryptocurrency, consider checking out our comprehensive guide on crypto investments for beginners.

Is it too late to buy Bitcoin?

History shows that it’s never too late to buy Bitcoin. The Bitcoin price today is still lower than its ATH, which means it may rise and go for a full-scale bull run again in the future.

FAQ

Is Bitcoin a good investment?

The forecast for Bitcoin price is quite positive. It is expected that BTC price might meet a bull trend in the nearest future. We kindly remind you to always do your own research before investing in any asset.

To maximize investment potential, one should regularly monitor their wallet Bitcoin balance and transaction history for accuracy and signs of unauthorized activity.

How much will Bitcoin be worth in 2025?

The Bitcoin network is evolving at a swift pace. The forecast for Bitcoin in 2025 is largely optimistic. Analysts expect the average price of Bitcoin to fluctuate between a maximum of $121,440.85 and a minimum of $45,871.41.

How much will Bitcoin be worth in 2030?

With a conducive environment for growth, Bitcoin’s future looks promising. Predictions for 2030 are highly positive, with business analysts anticipating that Bitcoin could soar to a maximum price of $500,000.

Will Bitcoin ever hit $100K?

In March 2024, Bitcoin’s price soared to a new all-time high of $73,800, a milestone that many view as the end of the crypto winter and the beginning of a promising new market cycle. With this resurgence, a wave of optimism has swept through analysts and investors alike, many of whom are now anticipating a powerful bull run by the end of 2024 and into early 2025. They predict that this momentum could propel Bitcoin’s price to even greater heights, potentially breaching the elusive $100,000 mark.For a deeper analysis of the factors influencing Bitcoin’s trajectory towards this milestone, as well as expert insights, refer to our detailed exploration in the article: When Will Bitcoin Hit $100,000?

Will Bitcoin go back down to $10K?

It is possible. After all, the cryptocurrency market is incredibly volatile, and the question of crypto regulation remains uncertain.

How high can Bitcoin go in 10 years?

In 10 years, Bitcoin may reach $1,000,000 or even higher. As long as there are no threats to it in terms of competition and regulation, its finite supply and growing popularity should ensure that it keeps conquering new price highs.

Why can there only ever be 21 million Bitcoins?

The simple answer to this question is “because it was designed that way.” Well, but why can’t this limit be extended? Among other things, BTC’s finite supply acts as a deflationary measure and is one of the reasons why Bitcoin’s price is as high as it is. As for why this exact figure was chosen, there are a few theories about it. One states that it’s because the total value of all physical money in the world when BTC was developed was equal to $21 trillion. As a result, if Bitcoin had been then to completely replace fiat, 1 BTC would have been worth $1M, and one satoshi — $0.01.

Is Bitcoin a safe long-term investment?

Bitcoin is a relatively safe investment compared to other cryptocurrencies. However, it is still a high-risk, high-reward type of asset and should not be seen as a reliable long-term store of value.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.