The crypto market continues to face a sharp downturn, shedding around 10% in the past 24 hours after the Federal Reserve’s latest policy update.

Bitcoin’s price plunged nearly 10%, hitting a low of $93,000. This marks a stark reversal from its recent high of $108,268 earlier this week.

The drop brings Bitcoin to its lowest level since mid-November, when it was riding a bullish wave spurred by market optimism following Donald Trump’s election victory.

Ethereum faced an even sharper fall, dropping by almost 15% and reaching $3,100—its weakest position since late November.

Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), and Cardano (ADA), also recorded double-digit losses, with data showing drops exceeding 10%.

Market analysts attribute this widespread sell-off to the Federal Reserve’s tightened stance on monetary policy. Although the Fed made expected adjustments to borrowing rates, it reduced its forecast for rate cuts in 2025 from four to just two. This hawkish outlook has added pressure to an already fragile market.

Additionally, the Federal Reserve clarified that it has no plans to support any proposed government Bitcoin reserve strategy, further dampening market sentiment.

Markus Thielen, the head of research at 10x Research, said that Bitcoin’s current price level serves as a critical marker for risk management. He noted that the Fed’s firm policy stance and potential liquidity adjustments expected from the US Treasury in 2025 have increased market uncertainty.

Liquidation frenzy hits the market.

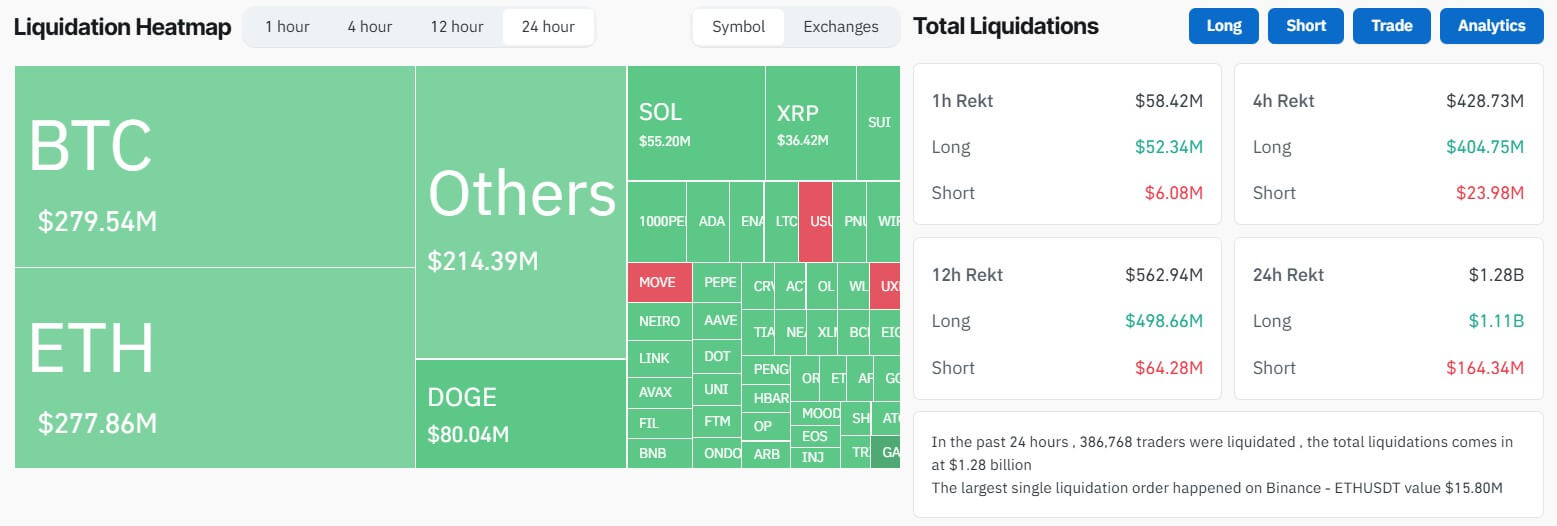

According to data from CoinGlass, the recent market turbulence triggered over $1.2 billion in liquidations, impacting 377,618 traders.

Long traders—those betting on price increases—took the brunt of the losses, losing approximately $1.07 billion. This marks one of the most significant setbacks for long traders this year.

Meanwhile, short traders wagering on falling prices lost $163 million during the reporting period.

Speculators on Bitcoin price suffered the most significant losses, with $279 million liquidated, including $227.5 million in long positions. Ethereum traders followed closely with $277 million in liquidations, including $248.7 million from long positions and $28.2 million from short positions.

Traders betting on Solana, XRP, and Dogecoin also suffered losses of $55 million, $36 million, and $80 million, respectively.

The most significant single liquidation occurred on Binance, involving a $15 million ETH-USDT transaction, further highlighting the intensity of the market’s recent volatility.

Mentioned in this article