Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin Cash price prediction shows that BCH may head toward the channel’s lower boundary which could later settle in consolidation.

Bitcoin Cash Prediction Statistics Data:

Bitcoin Cash price now – $313

Bitcoin Cash market cap – $6.17 billion

Bitcoin Cash circulating supply – 19.75 million

Bitcoin Cash total supply – 19.75 million

Bitcoin Cash Coinmarketcap ranking – #15

Evaluating a cryptocurrency’s potential often benefits from early investment. For instance, Bitcoin Cash (BCH) with a current 24-hour low of $311.42 and a high of $325.87 has seen dramatic fluctuations over time. It reached an all-time high of $4,355.62 on December 20, 2017, reflecting a 92.82% decline from that peak. Conversely, it hit an all-time low of $75.08 on December 15, 2018, but has since surged by over 316% from that low. This historical performance highlights both the token’s volatility and its significant recovery potential.

BCH/USD Market

Key Levels:

Resistance levels: $400, $420, $440

Support levels: $240, $220, $200

BCH/USD has been trading within a downward channel, encountering a significant resistance level at $313. This level has historically served as both support and resistance, making it a crucial barrier for BCH. Recently, the price attempted to break out of the moving averages but was rejected at the $326 level, emphasizing the strength of this resistance.

Bitcoin Cash Price Prediction: BCH Price May Consolidate Below the Moving Averages

Despite the recent rejection, the Bitcoin Cash price has formed several bullish patterns, including a breakout from a long-term falling wedge. This pattern suggests a potential for upward movement, but the price is now testing the $311 level that has provided strong support. However, this support is critical, as a breakdown could lead to further declines, potentially testing the channel’s lower support at around $250. Any further downtrend could hit the critical supports at $240, $220, and $200.

Nonetheless, if BCH manages to break out of its current downward channel, the next significant resistance level to watch could be around $360. A breakout above this level could initiate a rally toward this target, offering substantial upside potential for traders. Meanwhile, if there is an increase in buying pressure, the price may break toward the channel to reach the $380 resistance. While trading at that level, a bullish continuation could reach the resistance levels of $400, $420, and $440 respectively.

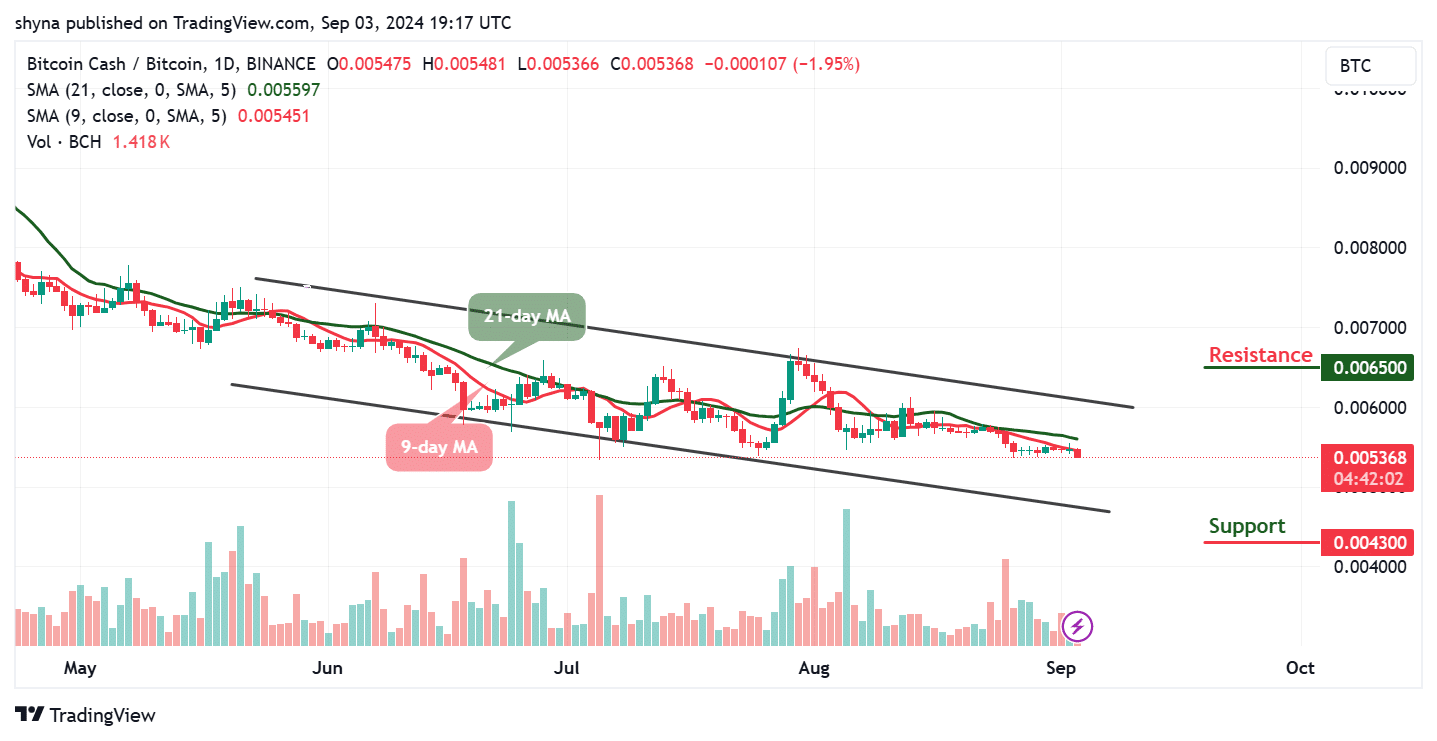

BCH/BTC Keeps Moving Bearishly

Against Bitcoin, Bitcoin Cash is likely to continue the bearish movement as the bears keep showing a serious commitment within the market. According to the recent negative sign, the bearish trend may continue as much as the buyers failed to push the price above the 9-day and 21-day moving averages.

However, the 9-day moving average remains below the 21-day moving average to confirm the bearish movement. Therefore, any further downtrend could hit the support level of 4300 SAT and below, but a bullish cross above the upper boundary of the channel may push the price to the resistance level of 6500 SAT and above.

Meanwhile, towards the end of August, @HBVT8375 updated his followers on X (formerly Twitter) regarding the future of $BCH. He noted that if $BCH closes the month above $400, similar to the previous month, it could signal the start of a significant bull run. However, if it doesn’t reach that mark, he advised accumulating more $BCH in preparation for future gains. This strategic outlook emphasizes the importance of the $400 level as a key indicator for potential upward momentum in the market.

August is going to the end. Whether $BCH close this month above 400$ like previous month. If so, a big bull rull for $BCH is ahead. If not, buying more. pic.twitter.com/mhkCchqtW4

— LEO68 (@HBVT8375) August 30, 2024

Alternatives to Bitcoin Cash

Bitcoin Cash is at a crucial point, with potential for significant price movements depending on its ability to break key resistance at $350 and maintain its uptrend support. At the same time, Pepe Unchained is drawing considerable market interest, with over $150,000 in recent inflows, distinguishing itself from other meme coins like Shiba Inu and Dogecoin. With a lower market cap, strong investor confidence, and over $11.7 million raised in its presale, Pepe Unchained presents a promising investment opportunity.

Pepe Unchained This Is A Must-Have Meme Coin. Here’s Why

Pepe Unchained, having raised over $11.7 million and attracted significant daily inflows, is emerging as a standout in the cryptocurrency market. Its advanced Layer 2 blockchain offers fast transaction speeds, low fees, and a dedicated block explorer. With projections indicating a potential 100x increase by 2025 and a 193% annualized staking return, $PEPU presents a compelling investment opportunity. The strong market interest and positive forecasts make now an excellent time to invest in Pepe Unchained, positioning it as a promising asset in your investment portfolio.

Visit Pepe Unchained

Related News

Most Searched Crypto Launch – Pepe Unchained

Layer 2 Meme Coin Ecosystem

Featured in Cointelegraph

SolidProof & Coinsult Audited

Staking Rewards – pepeunchained.com

$10+ Million Raised at ICO – Ends Soon

Join Our Telegram channel to stay up to date on breaking news coverage