Lululemon’s strong growth has made it the second most valuable sportswear brand globally, driven by international demand, and a loyal customer base.

Despite recent gains, Lululemon’s valuation remains relatively low compared to peers, suggesting potential upside if growth continues.

However, risks from competition, shifting consumer trends, and economic uncertainties could impact its growth trajectory.

After rising by over 10% since its last earnings report, Lululemon overtook Adidas to become the world’s second most valuable sportswear manufacturer. What many wrote off as a stock past its prime is looking more like a diamond in the rough. While most retailers struggle with weak consumer trends and global economic uncertainty, Lululemon continues to stand out.

This athleisure designer is keeping its top-line growth going, propelled by new designs, store expansions, and surprisingly strong demand in China. Couple that with a loyal, higher-income consumer base, and you have the recipe to defy industry trends.

But after its latest rally, investors must ask: Is this yoga-based brand priced for perfection, or is there still room to grow?

What does Lululemon do?

Lululemon Athletica transformed from a niche yoga-wear brand into a global athleisure player, offering a wide range of products—from technical athletic clothing and footwear to fitness accessories—for both men and women.

Lululemon embraced e-commerce and made online sales a key part of its strategy and enabled the brand to expand its footprint. Its unique approach to marketing – creating a sense of community and belonging made Luluemon not just a brand, but a lifestyle. This has been a successful playbook for many brands.

How is management handling growth?

Lululemon is executing its Power of 3×2 plan, which laid out targets in 2021 to double three KPI’s by 2026.

(lululemon.com)

Firstly, Lululemon plans to double men’s revenue by 2026. It’s using its proven model of technologically advanced premium fabrics to establish itself in men’s running, training, and yoga, while expanding into new categories such as tennis, golf and hiking and tapping into footwear and accessories.

Secondly, the brand doubled down on e-commerce and intends to double online revenues by 2026. They have a solid foundation already. Over 39% of sales are done online and Lululemon has over 24 million membership users, reinforcing its community approach.

Thirdly, the company plans to quadruple global revenue from 2021. It has significant opportunities to expand globally, having recently entered China and started expansion into EMEA and APAC. Out of its 749 stores, 138 are in China, 47 in Emea and 105 in APAC, establishing a foothold in these markets and creating further opportunities for Lululemon.

Where Lululemon is lacking

Skilled management is the key to success in the world of fashion. Under the current CEO, the company has been expanding, but it came at a cost. Luluemon has lost some of its luster with a lack of innovation, or what the company calls “newness”. It identified and started working on the issue, managing to slightly revive growth in the last quarter, particularly in the troublesome women’s segment.

We have to mention the U.S., where comparable sales were down -3% for the first time last quarter. Weakening consumers have dragged on many businesses, and it was time for Lululemon to feel the sting.

This scary trend has somewhat reversed course as revenue growth increased to 2% YoY and comparable sales declined -2% as compared to -3% last quarter. It remains to be seen if this is a long-term recovery trajectory or a seasonal blip, but management was positive about US growth on the earnings call. Improving macroeconomic conditions may provide a boost to sales in 2025.

Quarterly beat spurred investor optimism

The December 2024 quarterly report showed a company still in growth mode. Net revenue for Q3 FY2024 reached $2.4 billion, representing a 9% year-over-year increase. This top-line expansion was fueled by a mix of store openings, improving e-commerce penetration, and successful product launches in the men’s and footwear categories. Comparable sales rose 3%, with gross margins of 58.5%.

Earnings per share (EPS) came in at $2.87, a notable improvement from $2.53 in the same period last year. The company also raised its full-year revenue guidance from a range of $9.5 billion to $9.7 billion, reflecting management’s confidence in sustaining this momentum.

China: Why Lululemon is excelling where others struggle

Sales in China surged by 40% in the first two quarters – with prices 20% higher than in the U.S. This is a striking demonstration of Lululemon’s pricing power.

While many Western retailers are facing issues in China amid changing consumer preferences and fierce local competition, Lululemon is bucking the trend. China sales surged by approximately 25% this quarter, outpacing growth in almost every other geography. So what’s the secret?

Lululemon’s brand message of wellness, quality, and premium craftsmanship resonates with Chinese consumers who value authenticity and lifestyle over bargain pricing.

Additionally, the company has localized its approach, partnering with local fitness influencers, hosting community yoga events, and offering products tailored to the preferences and climate of Chinese cities. Combined with Lululemon’s digital strategy—leveraging Chinese social media platforms and integrating with local e-commerce giants—enables it to meet consumers where they shop. This approach has allowed the company to keep its Chinese operations growing.

Is Lululemon undervalued?

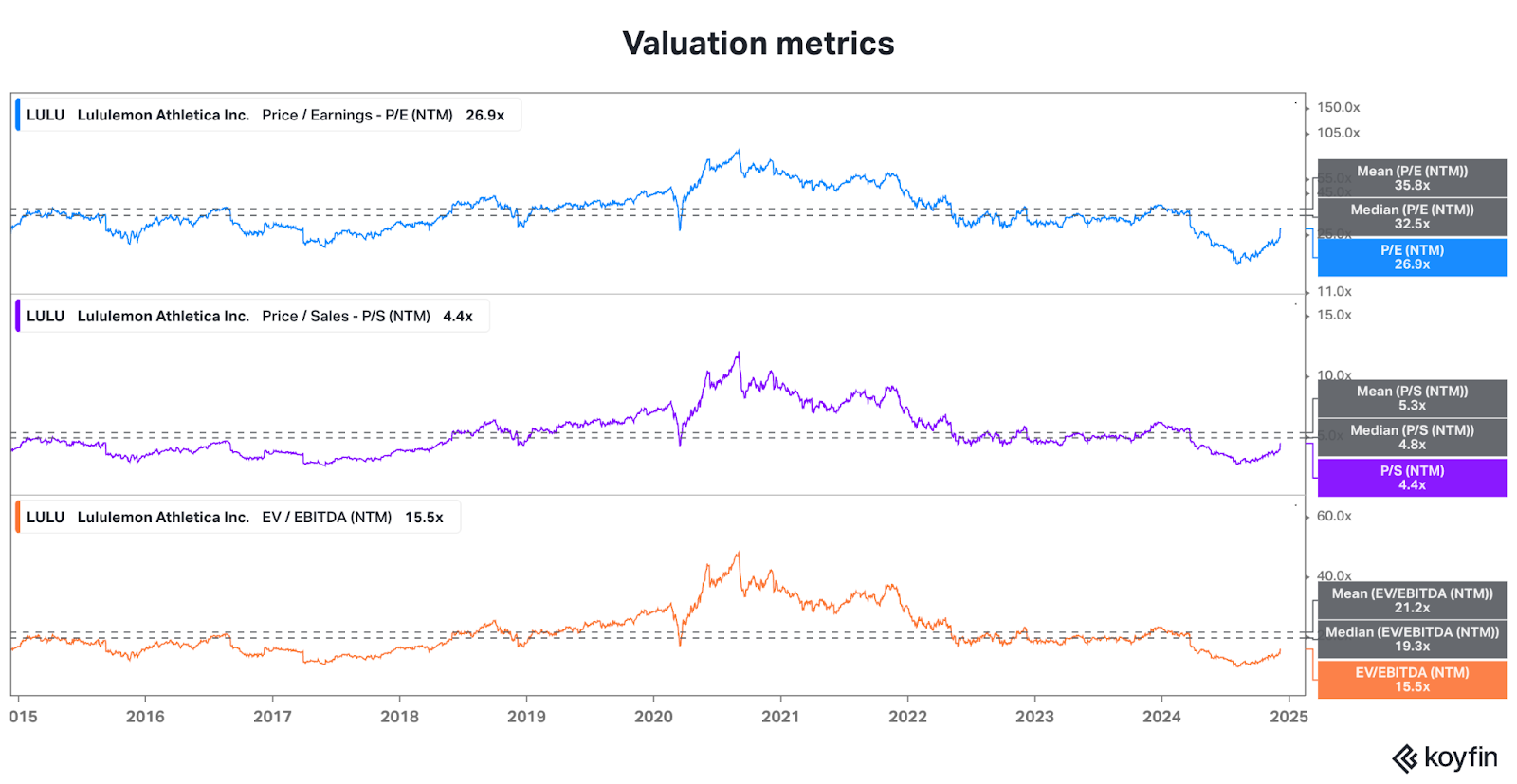

(koyfin.com)

Thanks to revenues growing 21% p.a. over the past 10 years, Lululemon’s stock was given a premium valuation. After growth collapsed in 2023, the valuation became its enemy, and the stock collapsed over 50% from its highs as investors feared that Lululemon’s growth was done for good. But with both revenue and earnings growth outpacing estimates and growing in Q3, investor sentiment has improved. Right now, the company’s P/E ratio stands at 27.43, which indicates about 20% upside from here to the historical median.

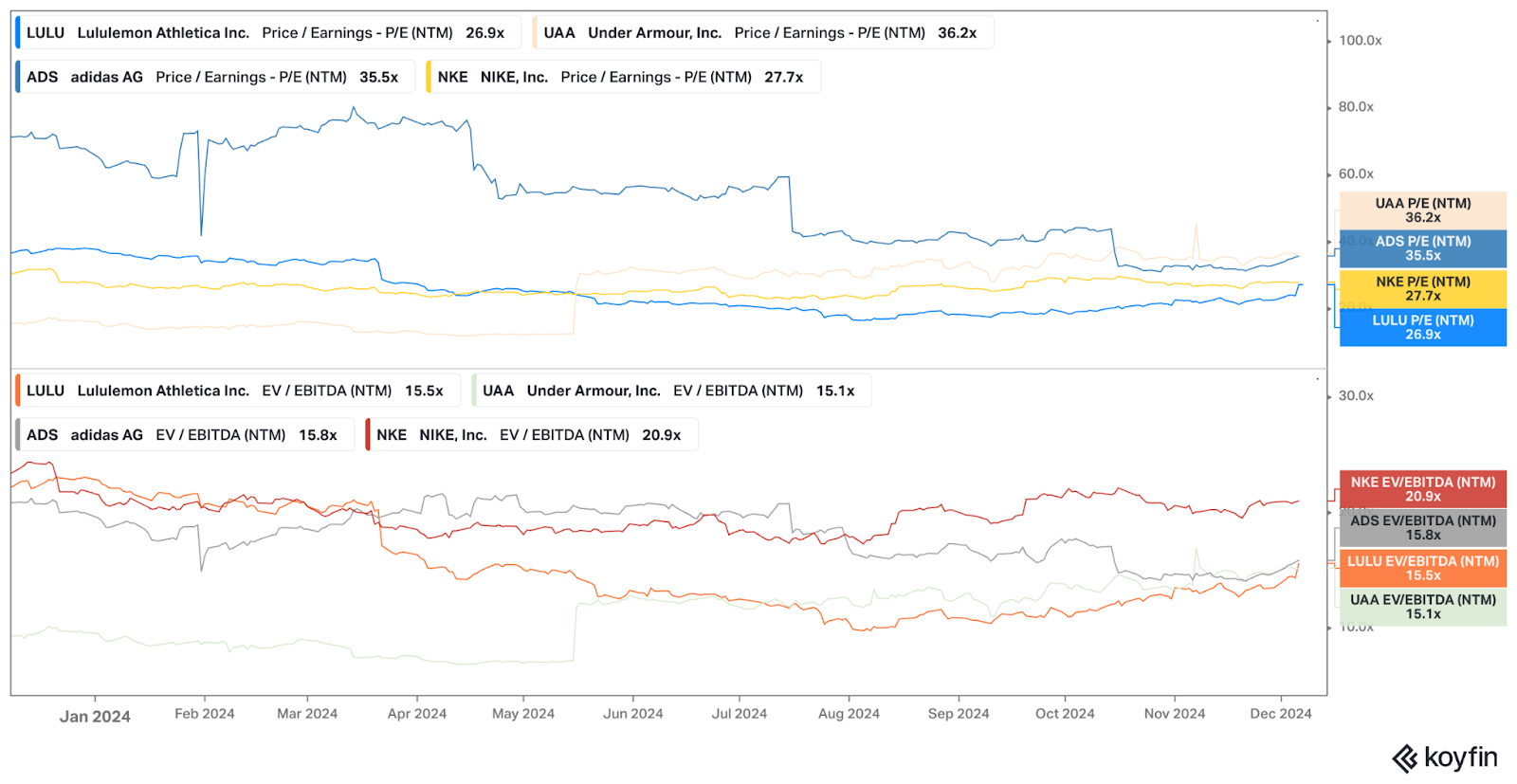

Looking at the valuation of its peers, we can see that despite strong performance, Luluemon’s stock is still trading at the low end of the group. This might reflect less appetite from investors, but also create an opportunity for the company to to grow if it proves itself to the market.

(koyfin.com)

Let’s look at three possible scenarios to see how Luluemon’s valuation stacks up:

Bull Case: Lululemon continues to grow earnings by 15%+ annually over the next five years, driven by geographical expansion and sequential growth and margin improvement thanks to a stronger consumer. In this scenario, long-term shareholders might reap significant rewards.

Neutral Case: Growth moderates to around 10% per year as markets like North America approach saturation and China’s growth normalizes. If margins stay strong, the valuation could compress to reflect slowing growth. While the competitive analysis suggests that Lululemon’s stock may keep growing, I would not expect explosive gains.

Bear Case: Weakness in China catches up to Lululemon, while slower global economic recovery might inhibit expansion. American consumers stay weaker due to higher rates for longer. Margins might face pressure from competition and higher input costs. The valuation might compress and leave investors with a stagnating or slowly declining stock.

For investors, it’s important to gauge how global macroeconomic conditions evolve and how they might affect the growth trajectory against high multiples. Lululemon may continue to outperform, but if growth stumbles, the stock could face a harsh valuation reset.

What risks is Lululemon facing?

Even the strongest brands face challenges. For Lululemon, risks include increased competition from established names like Nike, Adidas, and emerging direct-to-consumer brands that could chip away at market share such as Alo Yoga or Vuori.

Consumer preferences in fashion and fitness can shift rapidly, and Lululemon’s premium pricing might leave it vulnerable if economic conditions tighten and shoppers begin to trade down. There’s already a rising trend of baggy oversized clothing as compared to the sleek, figure enhancing style of Lululemon’s products.

Supply chain disruptions, rising material costs, or unexpected geopolitical tensions could also dampen growth, especially because of the risk of trade wars with China.

Outlook for the business

Lululemon stands at a juncture. The company’s latest quarterly results show no sign of slowing down, with growth firing on multiple cylinders. But we cannot ignore the fact that Lululemon is a standout in the industry. It’s questionable whether the company is really a diamond in the rough, or if consumer weakness just hasn’t caught up to this brand yet. Investors need to decide whether they’re comfortable paying top dollar for growth that depends on continuing stabilization of economic conditions.

For long-term investors who believe in the premium brand, the stock may be a buy. But if you prefer conservative bets, waiting for a better entry point might be your best yoga pose. In the end, Lululemon remains an attractive business, but in the apparel industry, success can be fleeting.